It’s no secret that my notion of ‘career moats’, as we’ve been exploring in this blog, originates from Warren Buffett’s conception of ‘economic moats’. Buffett believes that the best businesses are ones with strong economic moats. He’s been known to say “I try to invest in businesses that are so wonderful that an idiot can run them. Because sooner or later, one will.”

To make use of a definition that I’ve cited multiple times on this website, an economic moat is:

… a business' ability to maintain competitive advantages over its competitors in order to protect its long-term profits and market share from competing firms. Just like a medieval castle, the moat serves to protect those inside the fortress and their riches from outsiders.

About three weeks ago I thought it would be a good idea to examine some economic moats, and to look for analogues in the realm of individual careers.

In this essay I'll be looking at a specific type of economic moat. I don’t have a good name for this; send me a message if you think there’s a better way of referring to this concept. For the sake of convenience, I’ll refer to this idea as ‘tie a good thing to a better thing.’

We'll begin by looking at three different companies that do exactly this.

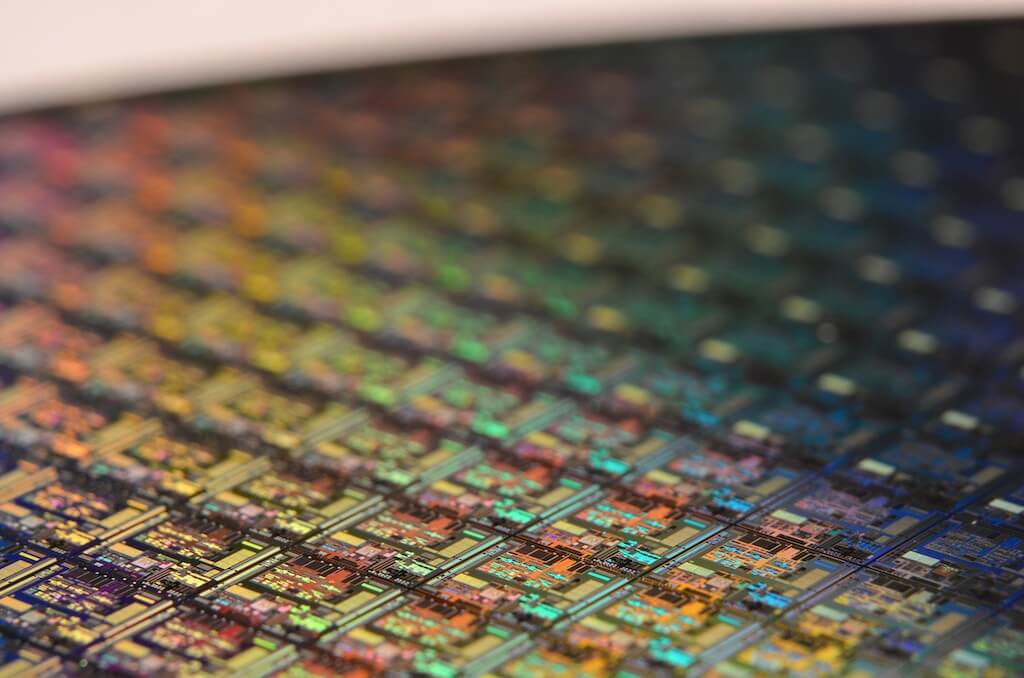

Qualcomm

Qualcomm is a chip company. The majority of Android phones today use Qualcomm’s Snapdragon chips; the flagship Google Pixel 3, for instance, uses a Snapdragon 845, and the flagship Samsung phone, the Galaxy S10, uses a Snapdragon 855.

You would think that Qualcomm’s business model is similar to Intel or AMD’s, what with it being a chip company and all, but you’d be wrong. In reality it's two businesses welded into one. Of the two, the chip business isn't the lucrative one: sand may be cheap, but Qualcomm has an extremely expensive ongoing R&D process that produces ever more powerful, energy-efficient SoC (System on a Chip) designs. This is a huge cost centre for Qualcomm; keeping up with the competition costs money.

Where Qualcomm makes up for this lower margin business is its licensing business: Qualcomm owns a portfolio of patents generated by its costly R&D process; it charges every phone manufacturer a licensing fee to use its LTE and CDMA patents regardless of whether it actually uses a Qualcomm chip. So Apple, for instance, pays Qualcomm a sum of money for every iPhone it makes, even though the primary SoC in the iPhone is Apple-designed (Apple switched to Intel modems with the iPhone XS — thus triggering a litany of lawsuits between Qualcomm and Apple; these lawsuits have since been settled, with Apple agreeing to return to using Qualcomm’s modems.)

What's important to remember here is that Qualcomm makes the bulk of its revenue from its chip business. But the profit margins on the licensing business are much higher — all of the costs in this latter business are amortised from its initial R&D outlay. This in turn means that most of Qualcomm's free cash flow comes from the licensing business, not the chip business.

In simpler terms: it costs money to make, ship and sell chips, but apart from the initial R&D costs, it doesn’t cost extra money to collect licensing fees.

You could say that a dollar invested in its licensing business returns way more money over the course of a year then a dollar invested in its chip manufacturing business. Qualcomm is thus best seen as a cash generating business tied to a lower-margin, high-output, cash greedy business, with the upside that the less-lucrative arm produces intellectual property that powers the lucrative business.

McDonalds

McDonalds is a fast food franchise. It sells burgers, fries, fizzy drinks, and soft-serve ice cream. If you were to take a step back and squint, you’d think that it’s a horrible business in a horrible industry: after all, restaurants are well-known for being low-margin and high competition. To quote the late food writer Anthony Bourdain:

Why would anyone who has worked hard, saved money, often been successful in other fields, want to pump their hard-earned cash down a hole that statistically, at least, will almost surely prove dry? Why venture into an industry with enormous fixed expenses (rent, electricity, gas, water, linen, maintenance, insurance, license fees, trash removal, etc.), with a notoriously transient and unstable workforce, and highly perishable inventory of assets? The chances of ever seeing a return on your investment are about one in five.

On the food-business side of things, McDonalds addresses these issues with a number of strategies: it takes in low-skilled workers and puts them through a systematised training system; it operates most of its stores as a franchise, cutting down on operating expenses; it centralises marketing in each region, benefiting all stores covered by the ad-spend for that locale; it relies on selling a standardised menu that uses standardised ingredients that may be purchased at bulk from a standardised set of suppliers in each location. It has a playbook — finely tuned over decades of running restaurants throughout the world. These systems, implemented at scale, gives McDonalds a small number of competitive edges that allow it to operate profitably in the food business.

But that’s still not what makes McDonalds the valuable business that it is. No matter how many tiny edges you may eke out in the food business, you won’t be able to build the sorts of incredibly lucrative companies that Buffett desires and that idiots can run. At best, you gain momentary competitive advantages, and then the market shifts and your margins collapse and you scramble to match your competition.

No, what makes McDonalds valuable is that it is really two businesses that are welded together. Like Qualcomm, the second business benefits from — but is more lucrative than — the first.

So, let’s recap: McDonalds’s first business is the business that you and I encounter whenever we order a Big Mac with a side of fries. It runs this business through a combination of franchisees and company-owned stores. Its second business, however, is a real estate holding company. This other business buys the underlying properties where its franchisees run restaurants and charges them rent. So while the restaurant business earns a relatively low-margin revenue stream, McDonalds gets to capture a larger percentage of that incoming revenue by charging rent instead of merely charging franchising fees.

To put actual numbers on that, the average rent per store captures 22% of average gross profits a year for franchisees. McDonalds itself owns $30 billion in real estate assets, generating annual profits of around $4.5 billion.

This secondary cash-generation stream is a high margin, low marginal cost revenue stream, and it provides the company with a buffer that it may use to protect itself from changing consumer behaviour or macroeconomic downturns. Plus, owning a large basket of real estate assets allows McDonalds to borrow money against those assets — something that an asset-light company would not be able to do.

If consumers start to eat healthier or a recession affects consumer spending, a plain-Jane restaurant is likely to suffer, putting its owners out of business. McDonalds, on the other hand, has a larger cash position with which to buy itself enough time to figure things out. The second business protects the first, even as it benefits from it.

Amazon

You can probably see where this is going.

Amazon is an ecommerce company that sells consumer goods at cheaper-than-average prices tied to convenient (and affordable) delivery options. It is able to compete with brick-and-mortar stores because it provides infinite selection at low prices.

But the ecommerce business is cut-throat, competitive, and low-margin. So Amazon isn’t ridiculously valuable on the back of its ecommerce business alone. It has a secondary business that generates high-margin revenues that it uses to insulate its lower-margin business: that is, it builds and owns Amazon Web Services (AWS). AWS provides computing resources for Amazon’s own ecommerce businesses. But that’s not the least of it: it also happens to power much of the current generation of cloud-based technology companies.

Like Qualcomm’s licensing business and McDonalds’s real estate holding business, AWS is a business with high initial costs (building data centres costs money) but low marginal costs, leading to high margins over time. And the numbers on AWS’s services are mind-boggling: the ride-hailing company Lyft is committed to paying AWS $8 million a month over the next three years; Apple pays AWS more than $30 million a month; Slack is committed to pay AWS $50 million a year over five years.

The dynamics of AWS and the importance it plays in the current generation of tech companies have led some to characterise it as an ‘Amazon tax’:

AWS is a tax on the compute economy. So whether you care about mobile apps, consumer apps, IoT, SaaS etc, more companies than not will be using AWS vs building their own infrastructure. Ecommerce was AMZN’s way to dogfood AWS, and continue to do so so that it was mission grade. If you believe that over time the software industry is a multi, deca-trillion industry, then ask yourself how valuable a company would be who taxes the majority of that industry? 1%, 2%, 5% — it doesn’t matter because the numbers are so huge — the revenues, profits, profit margins etc. I don’t see any cleaner monopoly available to buy in the public markets right now.

And Walmart itself thinks that AWS’s revenues could be funding Amazon's retail fight against competitors — an opinion shared by a number of other tech pundits.

My point is this: Qualcomm’s, McDonalds’s and Amazon’s businesses are a less lucrative business tied to a more lucrative one. The second business benefits from and insulates the first. It is a good thing tied to a better thing.

I don’t mean to say that these analyses are complete — in fact, I expect to have missed important elements of each business, and I know for sure that I’ve glossed over certain details in summarising the form of these company’s economic moats.

My question, however is far simpler: how might you take this particular pattern of an economic moat and apply it to an individual’s career?

Time Allocation as Capital Allocation

Most of us do not have the ability to deploy large amounts of capital in a portfolio of different businesses. (If you do, congratulations! I’m suitably jealous. And, uh, this blog probably isn’t for you.) The analogy between economic moat and career moat breaks down if you regard capital allocation as a purely financial thing.

My take, however, is that we can map the question of capital allocation as a question of time allocation. Businesses have to allocate capital in a way that gives them suitable returns; the smarter ones allocate capital in a way that gives them economic moats. Individuals, on the other hand, may allocate time in a way that gives them a career moat.

In any given work week, you have a certain number of productive working hours — both in the office and after you come home. (It doesn’t matter that you don’t have a lot of time on your hands — if you have young children, it is true that you’re going to have less time to dedicate to your career as compared to the average 20-something. But the point here is to allocate whatever time that you do have, or to find ways to increase that time which is yours.)

The question then becomes: how do you allocate time in a way that benefits you in the long run? The first level of argument here is that certain types of work have more valuable potential outcomes, and it pays to allocate some of your time on such work. Needless to say, not all the work you do in your day job is likely to help you become better in the long run.

This in itself isn’t particularly revolutionary: it’s a well-known idea in design and programming circles to engage in side projects while working a day job. There’s also this notion of the ‘side-hustle’, which is to start a tiny business on the side to augment your income.

Where I differ is to layer a second level on top of this argument, and to point out that not all side-initiatives are equal. Hence the title of this post: ‘tie a good thing to a better thing’. The good thing in your career is kind of set: it is whatever skills or capital you gain in your day job. The better thing is to find some side-project or hustle or activity that augments — or is augmented by! — whatever you acquire in your primary job.

So, some examples of this: you learn the Elixir programming language in your day job. You write an Elixir book in your spare time and turn that into conference talks and build up your reputation as a skilled Elixirist and use that brand power to get to a better job in your next gig.

Or: you start out of university as a good but undifferentiated designer. You spend the first four years of your career — while you aren’t tied down with adult responsibility — taking on side projects at night to double your exposure to design and branding problems. Your day job teaches you client interactions; your personal time is spent learning the craft of design. Each augments the other. You end up at Pentagram.

Or: you start out in Silicon Valley as a nobody, begin writing a blog that captures your experiences and lessons, which leads to more opportunities for learning and growth, which leads to more writing, which leads to accidentally inventing the term ‘growth hacker’, which leads to more recognition, which leads to a job as general partner at the venture capital firm Andreesen Horowitz.

I hesitate to include these examples, because they are limited to the domains that I am familiar with. The core idea seems more valuable: look for career analogues that resemble the way that Qualcomm, McDonalds and Amazon have tied a good business with a better business. One feeds into the other, and gains benefits in return. This might mean finding activities that augment or are augmented by some facet of your day job, and spending time working that into your weekly schedule. Or it might mean something else; I don’t know the details of your career or your industry to say confidently.

But I will note that the synergy — I hate that word, it’s so overused — seems to be key; you’re likely to benefit from whatever side bet it is you’re doing if it ties back to your day job. Your day job, after all, is the thing that you spend most of your working hours on. It's probably the best to find a way to tie that good thing to a better thing. Good luck.

Originally published , last updated .