This is a summary of a great 🌿 branch book. I intend this post to be a comprehensive summary for myself, but you should definitely buy the book if you are a practitioner who intends to engage in company positioning — Dunford writes about technê, which means that you should read the full thing before starting on trial and error. Read more about book classifications here.

April Dunford has had a long career positioning products for enterprise tech companies. (See Twitter thread here; the gist of it is that she worked on 16 products across seven different startups, and the various big companies that acquired said startups).

Obviously Awesome is her book about the art of product positioning. I read it last week because I was consulting for a friend's company in the middle of repositioning itself; I realise that my summary might be useful for those of you who would like to think about positioning at the level of an individual career. Dunford's ideas don't map neatly to a career arc, but there's enough in here that's relevant, so I have no qualms recommending it.

This book is not about the theory of positioning. Instead, it covers a 10-step process for finding product positioning. Dunford asserts this is a process you might have to repeat over the course of your company’s life; markets change and products have to change with them.

What is Positioning?

Dunford opens the book with definitions because she says that positioning, as a concept, is so old. People have a preconceived notion of what positioning is, how it looks like, what it is for. If we want to position well, we need an instrumentally useful understanding of positioning.

Dunford argues that positioning is context:

When customers encounter a product they have never seen before, they will look for contextual clues to help them figure out what it is, who it’s for, and why they should care. Taken together, the messaging, pricing, features, branding, partners and customers create context and set the scene for the product.

There are a couple of deep implications here, so it’s worth spending a bit of time to unpack this.

The first implication is that world class products, positioned poorly, can absolutely fail. In her first startup, Dunford was selling a database product developed by a bunch of PhDs. At the time, the world didn’t want a fancy new database — and it showed in the way they were greeted in sales meetings. Often, her team would be booted off before they’d finish their presentation. They found themselves spending half their time trying to explain how their database was different or better compared to existing databases prospects were currently using. Prospects didn’t want something new that they would then have to integrate into existing systems, nor did they think that the product’s advanced analytical capabilities were worth the cost of switching from other databases.

Dunford eventually found a prospect who argued that they were not a database product at all. In his view, they were a business intelligence tool, or more specifically a data warehouse. This wasn’t true in Dunford’s team’s eyes, because they thought that their product lacked features traditionally associated with data warehouses. However, because their product’s analytical capabilities were so much more superior than existing warehouse solutions, they actually had an edge (vs when compared to the database market at large).

This positioning had an immediate impact on sales meetings with prospects. Prospects stopped comparing the solution with databases they had already purchased. They intuitively understood the specific problem the product solved, and the value to the business.

The repositioning also changed the way Dunford’s company saw itself. They stopped working on general database features, and threw all their engineering time into features that augmented the data warehousing use case. Their marketing and sales shifted to highlight their positioning. Sales went up … and the startup was eventually acquired.

Why is context so important? The reason it’s important is because context is how we evaluate products. As consumers, we are inundated with too many choices. To cope, we default to framing products based on other products that we already understand e.g. “the hoverboard is a skateboard … with a motor”. This means that a product’s chosen frame of reference determines how that product is evaluated.

Dunford then asserts that many products are exceptional only when we understand them within their frame of reference. In her first startup, they could not have possibly succeeded as a general database company. It was only when they repositioned themselves as a data warehousing solution that their product’s value became clear.

Why does bad positioning happen? Dunford thinks it happens for two reasons, which she calls ‘the two traps’.

- Trap One: Your default association blinds you to alternative ways of framing the product. Let’s say you start out by building a database. As time goes on, the product changes as you respond to feedback. Because this process happens over a long period, you lose sight of the fact that what you have built is now an entirely different product from before. You still use the old messaging. Customers are thus confused by your offering, because it doesn’t stand out in your old frame of reference.

- Trap Two: Your product is designed for a market … but the market then changes. Say you sell a ‘diet muffin’ with seeds and nuts. After a number of very successful years, a competitor opens across the street and you notice that you’re losing customers. You head over to buy their product … only to find they’re selling the exact same thing, only they’re calling it a ‘gluten-free paleo snack’. In this scenario you’ve got a great product, but you failed to adjust the positioning as the market shifted. The market now thinks that ‘being on a diet’ isn’t as healthy as being ‘gluten-free’ or ‘living a paleo lifestyle’.

Signs You Have Bad Positioning

There are a couple of signs of bad positioning.

- Your current customers love you, but new prospects can’t figure out what you’re selling. The fact that some current customers love you means you are delivering value. But if new prospects don’t understand what you’re doing, they will misrepresent you and misunderstand your value.

- Your company has long sales cycles and low close rates, and you’re losing out to the competition. Products with a strong position make their value obvious, attract suitable customers and sell quickly. Positioning tells you which customers to go after. Without this, you’ll target prospects who are not a good fit for your product. Or you will close them, only for them to realise you are not what they need.

- You have high customer churn. This is expressed as customers churning shortly after purchase, as well as new customers who are constantly asking for features you have no plan to deliver. Dunford writes: “Customers who misunderstood your value chose you for the wrong reasons, and now they’re trying to recover sunk costs by turning your product into what they thought they were getting.”

- You’re under price pressure. Customers complain that your prices are too high. The reason this happens is because you aren’t differentiated, and are therefore seen to be like everything else on the market. If you have clear positioning, clients can easily see the value that you are delivering, which allows you to price for that value.

The 5+1 Components of Positioning

What are the components of positioning? This is the goal we are working towards.

The traditional approach to finding positioning is to fill in a positioning statement. It looks like this:

For target buyers, your offering is a market category which provides competitor’s benefits unlike primary competitor which provides competitor’s benefits.

This is pretty terrible, because:

- It assumes you know the best way to fill in the blanks. The statement might do a good job of capturing your current thinking, but it doesn’t give you clues about whether the positioning is good or bad.

- It reinforces the status quo. Most products are not explicitly positioned because people just fall back to the default frame of reference (see trap one, above). This statement just asks people to restate their current frame, instead of encouraging them to be creative and think of alternative positioning options.

- It doesn’t give you hints on what to do next. Ideally, positioning should inform product roadmaps, prospect qualification, marketing messaging, etc.

- It’s difficult to remember, which makes it difficult to use by sales, marketing, product, engineering, etc.

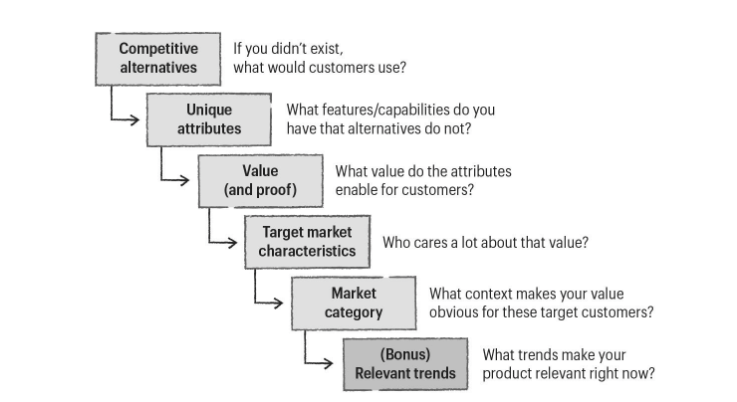

That said, Dunford thinks the core components implied by the positioning statement is a good start. A good positioning process aims to search for the following 5+1 components:

- Competitive alternatives. What customers would do if your solution didn’t exist. This might be ‘do nothing’, or ‘use Excel’, not just competing products.

- Unique attributes. The features that you have that alternatives lack. Note that this can also be things like delivery model (installed on-premise vs SaaS), specific expertise (your clients are investment banks), or even customer support (people like that you’re in the same timezone).

- Value (and proof of that value) The benefits that those features enable for customers. This must be backed by objective proof, not internal opinions.

- Target market characteristics. The common characteristics of users or buyers that seem to really care a lot about the value you deliver. This is the subset of your market who buys quickly, rarely asks for discounts, and tell their friends about your offerings. You want to be explicit in selecting this target market because you don’t have unlimited salespeople or marketing spend.

- Market category. The market you describe yourself as being part of, to help customers understand your value. Think of this as a frame of reference. When you refer to your market category, you’re going to trigger a whole set of assumptions, so it’s important to think carefully about this.

- (Optional, potentially dangerous) Relevant trends Trends like big data, AI, or VR, which make your product more relevant right now. The goal is to get attention, and therefore a slice of the buyer’s budget. (e.g. Dunford gives the example of ‘direct-to-buyer’ initiatives in consumer goods companies; by positioning a sampling service as ‘direct-to-buyer’, Sampler got way more traction than if they just positioned themselves as ‘an online product sampling company’).

The important thing to note is that all of these elements are related. Your product is only unique when compared with competing alternatives, it has attributes that drive value, which in turn determines who the best target customers are, which in turn tells you which market frame of reference is the best one to highlight your value.

Dunford argues it’s important to start with what customers view as competitive alternatives first, which leads naturally to everything else.

The 10 Step Process

The next section is the actionable part.

Step 1: Understand the Customers Who Love Your Product

For most of her career, Dunford struggled with finding a good starting point for the positioning process. She eventually realised that her most successful positioning attempts all started by looking at the company’s happiest customers.

In one case, we tried to survey all of our customers to see why they loved us, and the results were muddy. There didn’t seem to be any patterns in why people picked us. I wondered if the results would look different if I only surveyed the ecstatic fans and left the moderately happy customers out of it. Suddenly a clear pattern emerged: all of our customers could look like these very happy ones if we focused our marketing and sales efforts on companies with characteristics similar to the ecstatic fans.

(…)

Taken as a whole, the customer base often seemed very heterogenous and it was hard to see a pattern in why they chose a product, who they viewed as competitors and what their favourite features were. However, if we sorted out just the best-fit customers, we could clearly see patterns.

The first step in the positioning exercise is to make a short list of your best customers. Your best customers are the customers who:

- Understood your product quickly and bought from you quickly.

- Became raving fans.

- Referred you to other companies.

- Acted as a reference for you.

These customers represent the perfect type of customer you want to buy from you … for the short term.

Make a list of them. You will use this list as a reference point for the rest of the 10-step process.

Implication 1: You can only do the 10-step process if you have a pool of super-happy customers. Until you have that, you should hold off on tightening up on positioning, and instead get your product in front of a fairly wide set of potential customers to spot emerging patterns.

Implication 2: Positioning for investors should be different from positioning for customers. Investors are investing in what your company will be in the future; customers are buying a solution to a problem they have right now. These are two completely different things. Customers are making an immediate decision to spend money they have right now to get immediate value and relieve an immediate pain. They don’t care about your plan for getting 1000 more customers, or about disruption (and in fact your plan to disrupt their operations might look terrifying to them).

Consequently, your website, sales, marketing and immediate product roadmap should be designed to serve customers in the short term, and should reflect customer positioning, not investor positioning. In Dunford’s experience, investors will understand this and will also understand if the story in your pitch deck is different from the story in your sales deck. This book, and Dunford’s process, is about customer positioning, not investor positioning.

Implication 3: What if your company sells multiple products? Should you position the company first or the products first? If the company has one primary product as a lead-in to all other ancillary products, position that primary product first. If the company has a suite of products, Dunford usually positions the company first, and then positions each individual product later.

Step 2: Form a Positioning Team

Positioning efforts usually start from marketing, because the marketing head feels the most pain from a lack of positioning. That being said, Dunford points out that positioning is so integral to business strategy it cannot be driven by marketing. A positioning exercise that is not a team effort, driven by the business leader, will fail.

Positioning impacts the business in the following ways:

- Marketing: messaging, audience targeting, campaign development.

- Sales and business development: target customer segmentation and account strategy.

- Customer success: onboarding and account expansion strategy.

- Product and development: roadmaps and prioritisation of features.

Dunford has two tips: first, get at least one person (but no more than two) from each functional department to the table. Normal meeting best-practices apply: you don’t want to have more than 9 people. Second, have a facilitator whose goal is to ensure that everyone’s voice is heard. Dunford is biased, of course, she offers 3rd-party facilitating services. But she points out that if you don’t have a 3rd party, such efforts may fail because nobody is willing to gently challenge long-held assumptions.

Step 3: Align Your Positioning Vocabulary and Let Go of Your Positioning Baggage

Dunford sets aside the first hour to go over positioning concepts and definitions with the team. This is — again — because people tend to have preconceived notions about positioning. At a minimum, the team needs to be on the same page regarding:

- What positioning means and why it is important.

- Which components make up a position and how we define each of these.

- How market maturity and competitive landscape impacts the style of positioning you choose for a product.

(Note: the first two concepts are covered above, in the first part of this summary. The third concept we will cover later).

The most important part of this step is to let go of preconceived notions of what your product is. Dunford takes extra time to emphasise that your product means different things to different people. Her database product was seen as a generic database to her team and to some customers, but seen as a data warehousing solution to the happiest subset of their customers.

This means that you should be free to consider your product in new ways too.

As another example, Arm & Hammer used to make baking soda, for (duh) baking. In the 70s, as packaged food was on the rise and baking on the decline, Arm & Hammer decided to change their positioning to odour control and cleaning products — after all, baking soda was also used for cleaning and for removing bad smells in refrigerators. They could only do this by dropping their old frame of reference (‘we make baking products’) and embracing a new frame (‘we make cleaning products’).

Step 4: List Your True Competitive Alternatives

Customers don’t always see competitors the same way you do, and their opinion is the only one that matters for positioning.

It’s natural for you to start looking at your product and its features to determine the best market, and then build a context and story around that. Don’t. The features of your product and the value it provides are only unique, interesting and valuable when a customer perceives them in relation to alternatives.

Second, it’s natural to then assume that you should ask your customer about their problems. Dunford argues against this. She says that most customers are terrible at describing their problems — and when they do so, they tend to describe it in ways that don’t give useful information.

Instead, ask customers what they would do or use if your product didn’t exist. An example: in Dunford’s database startup, she asked customers what problems they used the database to solve. The customers answered “we just want to run a fast query”, or “we have to produce a report, so we need to retrieve data from a large db very quickly.” From those answers, Dunford thought they viewed her product as a database that can quickly execute queries. But when she asked them what they would use if her database didn’t exist, none of them named another database; instead they suggested BI tools, or data warehouses.

Therefore, the best way to understand your product’s real alternatives is to answer the question: “What would our best customers do if we didn’t exist?” These answers may include ‘do nothing’, ‘use a pen and paper’ or ‘hire an intern to do it’ in addition to competitive solutions.

Make a list of these competitive alternatives. While doing so, make sure that:

- You focus only on your best-fit customer list that you created in Step 1.

- You rank the list from most common to least common. You may ignore the least common competitive alternatives.

- Do not list edge-case customers who are aware of smaller competitors, or who have super unique reasons for considering an alternative. You only want the most general case for your best customers.

- As a final step, group the alternatives into similar solutions. For instance, ‘do it manually’ includes ‘hire an intern’ and ‘do it in Excel’, and ‘use a small-business accounting solution’ includes ‘use Quickbooks’ and ‘Freshbooks’.

On point 3: Remember that you are an expert in your space, and you understand the real competitive landscape much better than your customers. If a competitor has a small number of customers, they are likely to have zero mindshare with prospects, and this should not be listed as a real competitive alternative.

At the end of this step, you should have a list of minimum two and maximum five grouped alternatives.

Step 5: Isolate Your Unique Attributes or Features

Now that you have a list of competitive alternatives, the next step is to identify what makes you different and better than those alternatives. Do not focus on value, which will come in Step 6. Instead, merely list attributes (features and capabilities) that your solution or company offers that competitors do not.

List every attribute that you can think of, even if it seems like it could be a negative to certain customers and even if you’re uncertain what its value might be.

- For tech companies, consider patented features.

- Think about feedback from customers when you ask them why they chose your solution. It might be that you’re the only company in the market with 24/7 support. Or that you are a consulting company with a certain combination of skills and experience. List all of that.

- It’s ok to list things here that some departments think is negative. Dunford tells the story of one company she consulted for where they were the only company in the market that required a professional services team to come onsite to install the software. The head of sales saw this as a negative, but the head of customer service saw it as a uniquely positive attribute, because certain customers wanted that type of customisation and high-touch service.

- Only list attributes if you have concrete proof. Do not list opinions. Every company believes ‘we provide outstanding customer service’, and thinks that their product is ‘very easy to use’. Dunford rejects such attributes unless they are backed by concrete evidence. For example: do you have more support people than competitors? Is your time-to-reply higher than competitors? What is it about your product that makes it easier to use, and how do your prove this? Is it because your product doesn’t require specialised training? Can you quantify how long it takes to become proficient in the product? If an independent reviewer or analyst says that your product is easier to use (or that your customer support is better), that counts as proof.

- Concentrate on ‘consideration’ attributes, not ‘retention’ attributes. Consideration attributes matter to prospects before they buy. Retention attributes determine whether a customer renews. For positioning, consider only the former, not the latter. This is because if your product is poorly positioned, you will not attract the right customers, so retention attributes won’t matter.

Don’t group your list of attributes at this stage. Just list as many as you can think of. Grouping will come at the next step.

Step 6: Map the Attributes to Value ‘Themes’

At this step, your goal is to whittle down the attributes to value ‘themes’. You’ll do this through two sub steps.

Substep one: for each feature or attribute, write the benefit and then the value. Features enable benefits, which can be translated into value in unique customer terms.

- Feature: something your product does or has. e.g. ’15-megapixel camera’

- Benefit: what the feature enables for customers. e.g. ‘sharp photo images’

- Value: how this feature maps to a goal the customer is trying to achieve. e.g. ‘images can be zoomed in or printed in large format and still look sharp’.

More examples below:

| Feature | Benefit | Value |

|---|---|---|

| All-metal construction | A stronger frame that resists damage | The frame lasts five times longer, allowing savings of $50,000 per year on frame replacements for the product. |

| One-click reports | Fast, easy report generation | Every part of the organisation can make better decisions based on accurate, up-to-date metrics. |

| 24-hour support | Support that is always available | Global operations have access to help across all time zones. |

Substep two: your next step is to whittle the common values into ‘value clusters’. By this point, you should see a handful of themes start to emerge. Your job is to take on the perspective of the customer, and lump together the points that are naturally related in their heads.

For example, if you have attributes like ‘works on any mobile device’ and ‘works without an internet connection’, these might provide value to customers who use your solution with field workers in remote locations. You could clump those attributes in a group called ‘supports remote environments’.

Remember: a value cluster might be supported by more than one feature, and each feature can have multiple value points. The goal of coming up with value clusters is to simplify your list of attributes from the previous step. You don’t need to be exhaustive here; you merely want to bring a resulting unique value to the front and center.

Step 7: Determine Who Cares a Lot

Once you have a good understanding of the value that your product delivers vs alternatives, it’s time to figure out your ideal customer profile. The marketing term for this is ‘segmentation’, which carries its own set of preconceived assumptions.

Dunford says that at this stage, it's really important that you don't fall into the trap of simplistic demographic thinking. You'll want to come up with attributes that best predict your most valuable customers. This should go beyond ‘men below the age of 50’ or ‘companies between 500-1000 people’.

Instead, what you want is a list of easily identifiable characteristics that tell you that a customer will really care about what you do.

How do you create this list? First, think of your happiest customers, and think of the value clusters you've created in the previous step. Your job is to map the value that your product’s features deliver to the group of customers that have the highest affinity for your product. You need to focus on each of the value points in the previous step and repeatedly ask yourself: who cares, and why? This should allow you to create a profile of a ‘best-fit’ customer, what they look like, and what pain-points that are most valuable to them.

In Dunford’s experience, this is either the easiest or most difficult step in a positioning exercise. Sometimes the value clusters indicate a clear subsegment of your current user base, along with identifying characteristics. (e.g. think of a customer who would only buy a product after they’ve had two failed data warehousing deployments). Other times, it’s not at all clear what the characteristics of an ideal customer subsegment is.

Dunford says that you should target your customer subsegment as narrowly as possible during your positioning exercise, because a) a well defined subsegment will allow you to deploy sales and marketing resources most effectively, b) you can always broaden the targets later and c) you will eventually have to broaden or change segmentation, because most products go through multiple repositionings over time.

How narrowly should you target, exactly? Dunford says this should be determined by near-term sales objectives. Ask yourself if your current definition of ‘best-fit’ allows you to hit your yearly sales target. If not, you’ll need to broaden your definition of ‘best-fit’.

Step 8: Find a Market Frame of Reference That Puts Your Strengths at the Center and Determine How to Position in It

Remember the description we had about picking market frames of reference? Well, the time has come for you to pick one for your product.

Your job at this step is this: pick a market frame of reference that makes your value obvious to the segments who care the most about that value. This is harder than you might think.

In the context of this exercise, a ‘market’ needs to be something that already exists in the minds of customers (except in the very rare case where you make a conscious decision to create a whole new market — which will be discussed later in this step).

You want to position your offering in a market to trigger a set of expectations — about competitors, features, and pricing — that work to your advantage. You must also release your expectations of your market: if you make a motorised skateboard, perhaps you might want to consider yourself a ‘personal mobility solution’, or a ‘last mile logistics vehicle’ instead of a ‘skateboard with electric motor’.

Dunford offers the following suggestions:

- Use abductive reasoning — If it ‘looks like a duck, swims like a duck and quacks like a duck, then it probably is a duck’. With abductive reasoning, you take a step back after considering your key features and its value to your best-fit customers, and then ask: what other products typically have these features? What category of products typically deliver this value?

- Examine adjacent (growing) markets — Another option is to look at markets adjacent to the one in which you are currently positioning yourself. Frequently, as a product is being built, it shifts to become more like a product in a neighbouring market. By looking at such markets, you might find one that might make your value more obvious to prospects. While doing this, pay attention to markets that are quickly growing. If you are lucky to fall into one of these, you’ll find that they have additional benefits: more customer attention, media focus and buzz, and the appearance of appearing new and cool.

- Ask your customers — this is a dangerous move, because prospects and customers are not experts in your market category, and will often try to position you in relation to their industry or job function. But sometimes, sharp customers can help by placing you in an adjacent market, which was the case for Dunford’s database startup.

After picking a market, think about how to win in that market. There are basically three options that you have available to you. You could decide to enter an existing market or create a new market. If you choose to enter an existing market, you can either compete to win the entire market or position your product to win a slice of it. Dunford names these three options:

- Head to Head — You are aiming to win an existing market, and your job is to convince people that you are the best. You will have to attack an established leader if one exists.

- Big Fish, Small Pond — You are positioning to win a subsegment of the market. Your goal is not to win against the market leaders, but to win by targeting buyers in a subsegment that have slightly different requirements (or problems) that aren’t being fully met by the current overall leader.

- Create a New Game — You create a new market from scratch. This is the hardest game to play. You have three jobs: first you need to prove to customers that a new market category deserves to exist, then you need to define the parameters of that market in the minds of customers, and finally you need to position yourself as the leader within it.

We’ll go through each of these styles, and talk about them in some detail.

Head to Head

You are competing directly against other established players in a well-defined market. Customers are well-educated about what solutions in this market should look like, and what they can and cannot do. They also understand the purchasing criteria (that is, what’s important to consider when buying).

Your play here is for the entire market — you’re not claiming you’re better for some subset, you’re saying that your product is the best solution for most, if not all, customers in this market.

When to use Head to Head style?

- When you’re currently the leader in this market. (Hah!)

- When you’re going after a leader. But this is really difficult, it’s like trying to out-cola Coke. This is a foolish approach for a small company to try, with a few caveats. Dunford thinks that for a large company, you should only take on an established leader where market sands are shifting in a way that could put the leader at a disadvantage or a challenger at an advantage. Otherwise, you’re going to have to fight hard for every win and hope your competitor makes a mistake.

- When you’re in a market where there is no clear winner. In this case, you benefit from the existence of a market, but you do not have to fear an incumbent.

Dunford notes that the head to head style requires a lot of capital, which might make it a bad idea for a bootstrapped company with less free cash lying around.

What to do when executing Head to Head?

- If you’re the market leader, your job is to continually reinforce the message that your current way of thinking about the market is the best one. This includes reinforcing the current buying criteria, reiterating why you are the best at delivering those things, and rigorously defending yourself against competitors who try to convince buyers to pay attention to other emerging criteria.

- Otherwise, your job is to convince customers that there are emerging changes or shifts in purchasing criteria that makes your solution the best. However, you are limited by the fact that the market is established, and that your product will be evaluated according to a known set of values and features.

Big Fish, Small Pond

In this positioning strategy, you’re targeting a subset of customers in a larger market with an established leader. The goal here is to carve off a piece of the market where the rules are a little bit different — just enough to give your product an edge over the category leader. Once you have a foothold, you can keep expanding your patch until you’re established enough to take on the category leader head-to-head. There are other advantages:

- You get the advantage of a well-defined category, without the stiff competition.

- It’s easier to dominate a small piece of the market, compared to full on, head-to-head market domination.

- Word-of-mouth marketing happens most naturally in tight market segments.

When to use Big Fish, Small Pond?

- This style requires that a category is well defined and there’s a clear market leader — but you are not it.

- There should be clearly defined groups of customers with unique needs that are not addressed by the market leader. (This could be buyers in a particular industry e.g. healthcare, with specific requirements e.g. products for .NET developers or even a specific language/geographic region!)

- The subsegment should be easily identifiable — meaning there should be a clear answer from Step 7.

- It has to be possible to demonstrate that this subsegment has a very specific and important unmet need. For instance, you might be targeting companies with workers in very remote places who can’t use a solution that requires internet access.

What to do when executing Big Fish, Small Pond?

- First, you need to educate the target subsegment about how a general purpose solution doesn’t fit their needs. You need to help the sub-segment understand what’s in it for them if they do have those needs met.

- Then, you have to show that while you exceed in some ways that are more suitable for your target subsegment, you do meet the underlying basic needs common to the overall market category. (Recall that you are not creating a new category, so you are still beholden to some of the more general expectations for the larger market).

- You should also be wary that market leaders may sometimes add ‘good enough’ features that partially meet the buyer’s needs, or buy a competitor to block your growth. You must understand that your subsegment must have truly distinct needs that are not met by the market leader … and that your competitive advantage must be difficult for the market leader to copy. (You could do this by patents … but more commonly Dunford says that you will pick functionality that damages the market leader in the broader market if they choose to copy you).

Story: Dunford’s second startup was a CRM company. Originally they tried competing against the market leader, Siebel, and were told they were a ‘lousier, cheaper Siebel’. Then one day they talked to an investment bank, and during their sales presentation they showed their relationship mapping tool, which was then unique to their solution. The investment banking buyer suddenly sat up in his seat and got very excited. He told them that investment banks were built on relationships, and such a relationship mapping tool would be a game changer for them.

Dunford’s startup had a huge debate internally on whether to go after this market. In the end, they decided they weren’t successful in the broader market anyway, so why not take the risk to specialise? There was a clear difference once they repositioned. Prospects paid closer attention. Marketing could really grok the investment banking market, and tailored their messaging for this segment. Sales began to use banking terms, and did demos with banking data. They had to raise their prices a huge amount, because investment banks were rich and wouldn’t take them seriously if they were too cheap. They also changed their product roadmap. In the end, they grew so fast that Siebel saw them as a competitor and acquired them.

Create a New Game

This is the hardest style of positioning to play. You pick this style if no other option is available to you — sometimes this is because a completely new technology or an underlying environment change has paved the way for a completely new market.

When to Create a New Game?

- When you have evaluated every possible existing market category and concluded that you cannot position your offering there.

- How do you know? Well, you realise that that playing in an existing market would fail to put the focus on your true differentiators and value.

- You may also consider this if you have a unique ability to spark interest and create demand. This applies if you are a genius marketer, or if you are a big company with enough resources to generate attention.

What to do when executing Create a New Game?

- Your first job is to convince the customer that a new category deserves to exist. At the same time, you need to teach them how to best evaluate solutions in this category. Finally, you need to teach people why you are the best vendor to deliver solutions in this category. Each of these three jobs may fail.

- The first job may fail if you are engaging in wishful thinking, and a new category doesn’t need to exist. (It could also fail because your product doesn’t compellingly demonstrate that it is very different from others, and that it delivers real value and deserves attention).

- The second job may fail if another competitor comes in. The upside, however, is massive, because you are able to create a market perfectly tailored to your strengths and weaknesses. You can set pricing, and define the boundaries of the market so they map exactly to the things you do best.

- The third job may fail if, after educating the market, a competitor swoops in and captures that educated market before you successfully convince everyone that you are market leader.

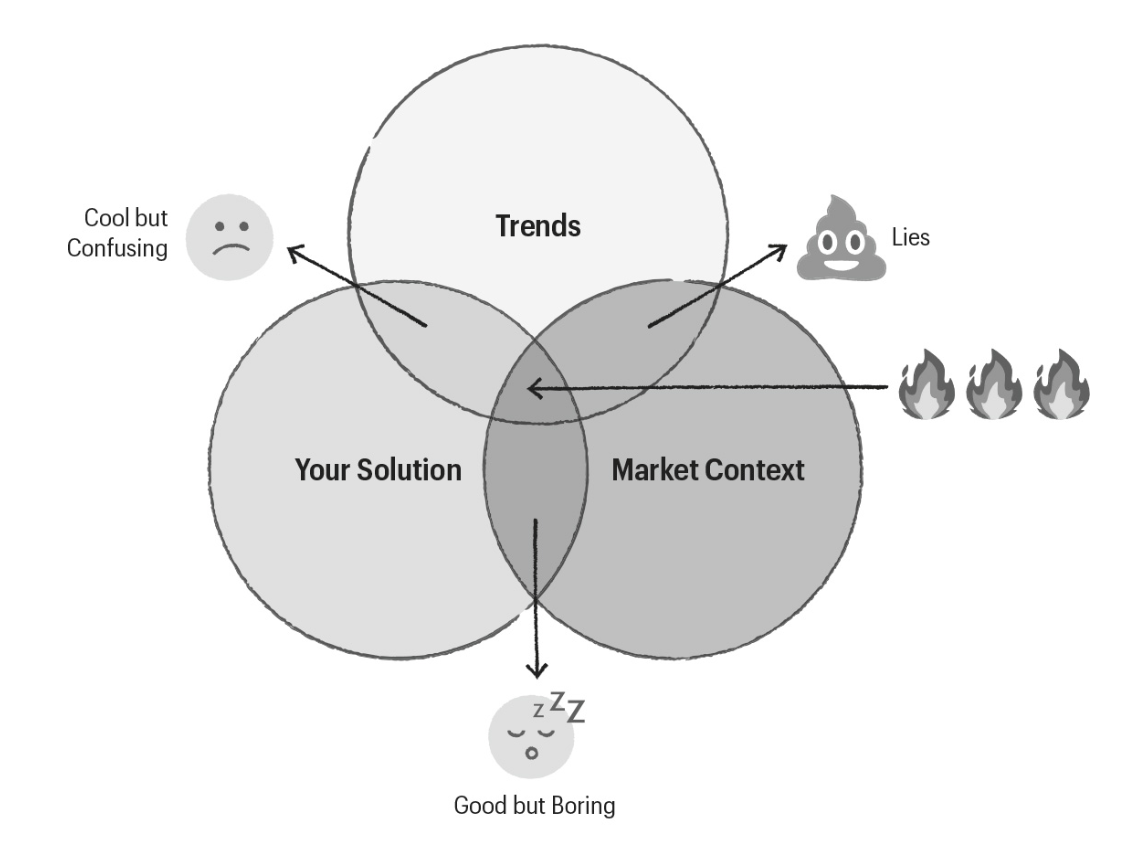

Step 9: Layer On a Trend (But Be Careful)

This might sound ridiculous, but trends can sometimes be helpful if you layer them on your positioning thoughtfully. Dunford talks about one of the startups she once worked at, that sold a product for retail sales associates that gave them access to e-commerce and in-store systems. An ongoing trend at the time was the concept of ‘mobility’ — every retailer believed they would need tablets for sales associates in every store in the near future, but they weren’t sure how to do that. Dunford said that adding ‘mobility’ to their positioning gave them a free source of attention they might not otherwise have gotten.

The danger, of course, is a buzzword soup that renders your product incomprehensible. Trends can only work when:

- You’ve declared a market, and have done all the previous steps in the positioning exericse.

- There is a clear link between your product and your market.

If in doubt, remember: it’s better to be boring and profitable than cool and baffling.

Step 10: Capture Your Positioning So It Can Be Shared

Last, but not least, you need to communicate your positioning to the rest of your company. As Dunford has mentioned before, positioning has deep implications for your sales, your marketing messaging, and even your product roadmap. You need to have the message spread throughout your organisation.

Dunford recommends just three documents as an output from the positioning process.

- A positioning canvas, which may be downloaded here (Positioning Canvas.pdf).

- A sales story, that can be referred to by everyone from sales outwards. (This is the typical Pain-Dream-Fix narrative arc structure that most salespeople are familiar with).

- A messaging document. This should be a single, master messaging document that is accessible company-wide, and it will serve as a starting point for every piece of marketing you do.

Once you have created these three documents, have them made available to everyone in your company. Dunford argues that both your product roadmap and your pricing might be affected by your company’s repositioning; you’re likely to have another discussion down the road on both issues.

Finally, Dunford says that positioning and repositioning is a fact of life — she’s been through too many to count, and sometimes for the same products over a long period of time. Her recommendation is to check in on your product’s positioning once every 6 months, to see if market dynamics, emerging technology, environment shift or competitor action have changed things for your solution. She also encourages you to perform a quick sanity-check whenever a large event occurs that might change market dynamics for your company. If necessary, redo the whole repositioning exercise again.

In summary:

- Any product can be positioned in multiple markets. Your product is not doomed to languish in a market where nobody understands how awesome it is.

- Good positioning rarely comes by default. If you want to succeed, you should explicitly position your product. Deliberate, try, fail, test, and try again.

- Understanding what your best customers see as true alternatives to your solution will lead you to your differentiators.

- Position yourself in a market that makes your strengths obvious to the folks you want to sell to. And, finally …

- Use trends to make your product more interesting to customers right now, but be cautious when you do so. Don’t layer on a trend just for the sake of being trendy — it’s better to be successful and boring, rather than fashionable and bewildering.

Dunford's website may be found here; I recommend reading her writing, buying her book, or following her on Twitter. If you're working on a product, Obviously Awesome is worth buying for the anecdotes and case studies; my summary can't capture the level of nuance that Dunford brings to the table. It truly is — to overuse a word a little — awesome.

Originally published , last updated .

This article is part of the Market topic cluster, which belongs to the Business Expertise Triad. Read more from this topic here→