In my last post I examined how first principles thinking fails. This post is going to be about a single, concrete example — about an argument that started me down this path in the first place.

A couple of months ago, a friend sent me a blog post titled Startups Shouldn’t Raise Money, over at a website called ensorial.com. I thought that the post was tightly argued and reasonably put together, with each proposition leading logically and coherently to the next. I also noticed that the author had taken the time to construct their argument from first principles … which meant it was difficult to refute any individual clause in their chain of reasoning.

But I also thought it was wrong. I told my friend as much.

“How is it wrong?” he immediately challenged.

“Well …” I began. And then I stopped. I realised I didn’t have a good argument for why it was wrong. Every axiom and intermediate proposition were ideas that I agreed with. And it wasn’t so simple as the conclusion being flat out mistaken — you could probably run a small, successful internet business using the ideas laid out in the posts’s argument (internet-based businesses tend to be simpler to manage, and there are many niches you can occupy).

But I felt uneasy because I thought the framing wasn’t as useful. This was a more complex thing to debunk.

The Setup

It’s easy to think that arguments have just three terminal truth values: right, maybe, and wrong. In practice, arguments (and in particular, the sort of argument that we use to justify actions) have many possible truth values. These include things like ‘got the details wrong, but is by-and-large correct’, or ‘is correct but for a different level of abstraction; doesn’t apply here’, or ‘is partially correct, but isn’t as useful compared to a different framing of things.’ The ensorial.com piece is interesting because I think it is an instance of that last one. It was what pushed me to start thinking about all the various ways first principles thinking could go wrong.

The author’s argument unfolds as follows:

- Startups are risky.

- Raising capital to do a startup reduces skin in the game (you’re spending other people’s money, after all).

- Once you have less skin in the game, it is easier to make bad decisions. The author argues this is due to a) having a capital buffer to cushion you, and b) having more time to waste.

- The alternative is to forego raising venture capital and to create a sustainable business from the beginning, ‘growing linearly with the number of people that give you money for your product.’

- This aligns incentives: you grow only by solving customer problems that they would pay you for. And you’ll pick the shortest path, because you don’t have the luxury of time given to you by an infusion of other people’s money.

- Therefore: startups shouldn’t raise money.

At first glance, there doesn’t seem to be anything that’s explicitly wrong with this argument. I agree with all the base ideas, and I found myself nodding to the intermediate propositions. The logical correctness of the argument wasn’t a problem. No, my unease stemmed from experience: I knew this wasn’t the right way to think about raising capital. But I couldn’t begin to construct an argument that went against it.

My friend and I spent no more than 10 minutes discussing this piece. But in the months after our conversation, I continued to return to the author’s argument. I thought it was interesting because it represented a type of thinking error that you and I are likely to encounter in our lives. The form of the error is subtle, and therefore more difficult to detect; the best description I have for it is: ‘perfectly rational, logically constructed, and not really wrong — but not as useful or as powerful as some other framing.’

Of course, my obsession was for instrumental reasons: how might you recognise a better framing when you found one? I’ll admit that I was a little naive here: I thought that if I could generalise the structure of this argument, I would be better able to recognise similar errors in the future. Alas, I have not been able to do this to my satisfaction.

(In practice, most of the older entrepreneurs I know seem to understand the problems with such sensemaking. Plausible arguments are dealt with in a simple manner: you try the recommendations that unfold from the analysis, but you remain alert to see if they give you exactly the results you want. If they don’t, you keep the frame for the time being, but you continue to look out for a better explanation. And how would you know if you have found a better way of thinking about your situation? Simple: you listen carefully. In the words of Malaysian magnate Robert Kuok, “you learn to distill wisdom from the air.”)

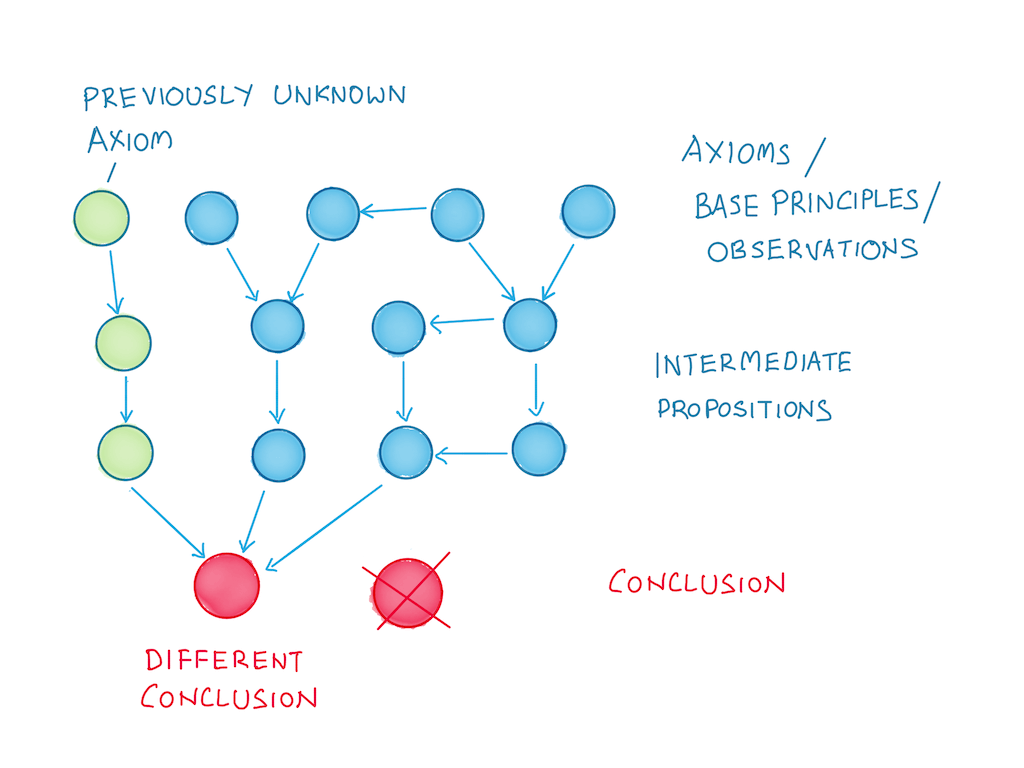

The most I’ve been able to do is to articulate how the author messed up — and therefore how first principles thinking may fail — something that I explored in my previous post. The core idea is simple: I believe the author started from a limited set of axioms. If you start from a wrong set of axioms, you would eventually end up with a flawed conclusion. In this case, I think the ensorial.com author started from a deficient understanding of business.

To generalise a little, people with limited understanding of business think that business is all about making profits. But those who actually run businesses know that running a business is all about managing cash flows.

And the ensorial.com author’s argument fails because they don’t appear to understand this.

John Malone and the Invention of EBITDA

In 1972, a 32 year old man named John Malone was offered the top job at Tele-Communications Inc (TCI), a cable company. He took charge on April Fool’s Day, 1973.

At the time of his hiring, Malone was president of Jerrold Electronics, a division of General Instrument that supplied cable boxes and credit to the cable systems companies. He had been offered the Jerrold Electronics job when he was 29 years old, just two years earlier. Before JE, he was at McKinsey Consulting. And before McKinsey, he had a job at AT&T’s famed Bell Labs, where he applied operations research to find optimal company strategies in monopoly markets. Malone concluded that AT&T should increase its debt load and aggressively reduce its equity base through share repurchases — a highly unorthodox recommendation at the time. His advice was delivered to AT&T’s board and then promptly ignored.

Malone had been thinking about the interplay between debt, profit, cash flow, and corporate taxes for some time. In 1972, when he was first offered the TCI job, he had already noticed a number of structural properties in the cable industry that piqued his interest:

- The cable industry had highly predictable subscription revenues. Cable television customers in the 60s — especially those in rural communities — were eager to upgrade to cable for better TV reception. These subscribers paid monthly fees and rarely cancelled.

- Cable franchises were essentially a legal right to a local monopoly, which meant that cable system operators had limited competition once it established itself in a given locale.

- The industry itself had very favourable tax characteristics — smart cable operators could shelter their cash flow from taxes by using debt to build new systems, and by aggressively depreciating the costs of construction. Once the depreciation ran out on particular systems, they could then sell them to another operator, where the depreciation clock would start anew.

- Most importantly, the entire market was growing like a weed: over the course of the 60s and into the start of the 70s, subscriber counts had grown over twentyfold.

Of course, Malone didn’t have much time to reflect on these observations. He landed at TCI and found the company at the brink of bankruptcy.

Bob Magness, the founder of TCI, had grown the company over the course of two decades using a ridiculous pile of debt — about 17 times revenues, at the time of Malone’s hiring. Malone spent his first couple of years at TCI fighting to keep the company alive. He flew into New York every couple of weeks, hat in hand, renegotiating covenants and asking for extensions on debt repayments. At one point during a meeting with TCI’s bankers, Malone threw his keys on the table and threatened to walk, leaving the company to the banks. The bankers capitulated, granting TCI a much needed extension.

Malone and Magness also had to worry about hostile takeovers, given TCI’s low stock price in the early 70s. They executed a series of complicated financial manoeuvres a year or so after Malone took over, placing a large chunk of stock in a holding company to grant them majority control. Later, they created a separate class of voting stock. These moves gave them hard control of the company, allowing Malone the freedom to focus on righting its finances.

After three years of hell, TCI was finally pulled back from the brink of financial disaster. And then Malone got to work.

Malone understood a few things about the cable industry that many outsiders didn’t. First, he understood that cable was like real estate: incredibly high fixed costs up front as you built or bought the systems, and then highly predictable, monopoly cash flows for a long time afterwards. He understood that if he used debt to finance acquisitions, he could keep growing the company, and use the depreciation on acquired systems (plus the write-offs from the loans itself) to delay paying taxes on that cash flow. Third, Malone understood that untaxed cash flows from all of those cable subscribers could be used to a) service the debt, b) pay down some of those loans — only when necessary; Malone wanted to keep the debt-to-earnings ratio at a five-to-one level — but more importantly c) demonstrate to creditors that TCI was a worthy debtor. And finally, Malone understood the benefits of size: the larger TCI got, the lower the cost of acquiring programming (i.e. shows and programs), because it could amortise those costs across its entire subscriber base.

The problem was that Wall Street in the 70s and 80s didn’t get any of this. In 1986, brokerage firm E. F. Hutton refused to publish a report on TCI because “we don’t publish reports on companies or industries that don’t show a profit.” And indeed, Malone’s strategy required TCI to show a loss for pretty much forever; for the next 25 years, it was never in the black.

Malone went on a charm offensive. He began talking to Wall Street analysts, explaining his logic. To make his point, Malone created a new accounting metric, something he called ‘earnings before interest, depreciation, and taxes’, or EBITDA.

Mark Robichaux writes, in Cable Cowboy:

Through a combination of logic, jawboning, and sheer force of presence, Malone persuaded Wall Street to take a second look at the cable industry, long shunned because of its nonexistent earnings and heavy debt addiction. Malone argued, successfully, that after-tax earnings simply didn’t count; what counted was cable’s prodigious cash flow, funding TCI’s continual expansion. Buying cable was like buying real estate. As the value of TCI’s franchises rose, so would the value of its stock. Net income was an invention of accountants, he declared.

Think about it, he’d tell a young analyst: Because TCI had high interest payments and big write-offs on cable equipment, it produced losses, and because it produced losses it paid hardly any taxes to the government. As long as cable operators collected predictable, monopoly rent from customers, met interest payments, and grew from acquisitions, why worry? Malone liked the mathematics of it: Tax-sheltered cash flow could be leveraged to land more loans to create more tax-sheltered cash flow. A standing joke around TCI was that if TCI ever did report a large profit, Malone would fire the accountants.

Malone was, essentially, a hacker: he stared deeply at the thicket of accounting rules, tax laws, and possible business moves, and found a strategy that exploited the structural realities he found in front of him. He was the first person to deploy this playbook rigorously, and TCI was amongst the first companies to start using EBITDA as a financial metric. Malone made good on his promise. Over the next 25 years, TCI went from acquiring cable companies to acquiring and investing in programming channels. It eventually became the largest cable company in the United States. It never turned a profit. And the results speak for themselves: from the year that Malone took over, in 1973 — to 1998 when AT&T finally bought it for $48 billion, the compound return to TCI’s shareholders was a phenomenal 30.3%, compared to 20.4% for its competition, and 14.3% for the S&P 500 over the same period. (Source)

Amongst business people and savvy investors, Malone’s logic dovetails with a famous saying: ‘cash flow is a fact; profit is an opinion’. Even today, there are people who do not fully understand the games you can play with cash flow. Or — more importantly — they do not understand the things businesspeople would do for better cash flows.

In the ‘misunderstood’ bucket, take Amazon, for instance. In 1997, a 33-year old Jeff Bezos announced that he was essentially adopting the same playbook, firing a shot across the bow with his first annual letter to shareholders.

Bezos wrote:

We will continue to make investment decisions in light of long-term market leadership considerations rather than short-term profitability considerations or short-term Wall Street reactions. (emphasis mine)

We will continue to measure our programs and the effectiveness of our investments analytically, to jettison those that do not provide acceptable returns, and to step up our investment in those that work best. We will continue to learn from both our successes and our failures. (…)

When forced to choose between optimizing the appearance of our GAAP accounting and maximizing the present value of future cash flows, we'll take the cash flows. (emphasis mine)

For the next two decades, Amazon grew its revenue and made no profits, leading journalist Matthew Yglesias to write, in 2013: “Amazon, as best I can tell, is a charitable organization being run by elements of the investment community for the benefit of consumers.” Bezos enjoyed it so much he put it in his annual letter the same year. Bezos knew what he was doing; Yglesias didn’t get it.

The Games People Play With Cash Flow

So, you might ask, what does John Malone have to do raising venture capital? The answer: more than you might think.

The core idea that you should take from Malone’s story isn’t “oh, it’s possible to build a valuable company with no accounting profits” — though that is a valuable insight — but instead “there is a whole genre of games that people play with cash flow” and also “cash flow is often more important to grok than profits.”

One implication of these ideas is that raising capital for a business has more to do with the nature of cash flows in a particular business model than it does anything else.

Notice, for instance, how Malone’s entire strategy was built around a single fact: that you have to pay up front for cable systems, but then earn back your money via a stable stream of cash for years and years afterwards. Notice how this extreme demand for capital drove Malone to embrace debt, over other sources of capital.

Now notice how closely this resembles the Software as a Service (SaaS) business model, which is the primary business model in today’s startup world.

(In SaaS businesses — like Slack, or Zoom — you pay programmers to create software, and then you pay even more money to sales and marketing to land customers. Then the customers pay you a stable stream of cash for years and years afterwards. Same dynamics: high upfront costs, and then a stable stream of comparatively smaller payments later. So while SaaS companies don’t typically use debt the way Malone did, they have — surprise, surprise! — similar capital requirements.)

Let’s return to the original question posed by the ensorial.com author: why raise money from investors? In fact, why raise money at all? There is only one real answer if you want to reason from first principles: you raise money due to the temporal nature of cash flows. To put this another way: in many businesses, you must spend money now to make money later. This implies that you’ll need a source of capital at the start of many business ventures.

This might seem like a stupid, obvious statement to make — and it is! But I’ve learnt that people with little experience of business (or little exposure to equity investing) are likely to miss out on the full implications of this single statement. As I’ve mentioned earlier, those with a limited understanding of business think that business is all about making profits; those who have actually run businesses know that operating a business is mostly an exercise of managing cash flows.

Here’s how I learnt this: in my previous company, I used to get frustrated whenever my old boss gave customers discounts in exchange for earlier payments. “We’ve done all this work!” I’d complain, “Why aren’t we getting paid our due?”

“Well,” he would say, “We need the cash.” I sighed, and said that I understood, but I still didn’t really get it.

Months later, I was kvetching about this practice to someone that I considered a mentor, when he interrupted me mid-rant: “But that is the logical thing to do, you know right?”

I was surprised. “How do you mean?”

“Think about it,” my mentor explained, “You’re running a completely bootstrapped business, which means you earn what you can sell. A huge chunk of your capital is locked up in inventory. Now your boss needs that cash back, to pay for expenses. You should view the discount he’s giving to customers as a price he’s willing to pay … in order to unlock that cash flow.”

It was then that I understood. It took me a few years, but I now get that a major part of business is simply learning the many games that you can play with cash flow.

For instance:

1) Payment Terms

Changing the payment terms on your invoices instantly makes your company more valuable, because you change the nature of cash flows in your business. (This is commonly exploited by private equity people, for obvious reasons … but I’ve also written about this before, in my summary of Ram Charan’s What The CEO Wants You To Know).

2) The Effects of Speed on Cash Flow

Once you realise that it is in the nature of businesses to do all sorts of things to unlock more cash flow, you begin to realise that there are all sorts of interesting ways you can exploit this tendency.

For instance, in Good Synthesis is the Start of Good Sensemaking, I described the consequences of an upstart competitor embracing lean manufacturing, from the perspective of the incumbent. The competitive advantage afforded by lean manufacturing is subtle: yes, you get to make stuff at a cheaper cost, with better efficiency and a lower error rate. But the true advantage that you get lies in the consequences of a speedy delivery: if you can guarantee a fast, consistent delivery time from your factory, your downstream distributors may hold less inventory — which in turn means that they would have a better cash position.

Why is this cool? Well, you’ll quickly learn that you can charge a higher price, enjoy higher margins, while still taking market share away from your competitors. Why? Simple: distributors will prefer to hold your product over a competitor’s, given the better cash flow it affords them. (This still requires a certain amount of price inelasticity; for an in-depth look at how this happens, read Competing Against Time).

3) Pre-payments in the Restaurant Industry

People can also play cash flow games the other way.

Nick Kokonas is a restauranteur who runs three of the best restaurants and bars in America: Alinea, Next, and The Aviary. A few years after starting in the F&B industry, Kokonas realised that he could charge for a deposit for a restaurant reservation — something that most people thought was impossible. He began collecting money up front. This changed the dynamics of his business in a pretty radical way. Kokonas describes what happened next (around 55:44 in this podcast):

Food costs money. But the way that everyone (in the F&B industry) looks at food costs, and paying for food is very weird. When COVID started, every famous chef that went on TV said, “This is the kind of business where this week’s revenues pay for bills from a month ago.” So when we started to bring in money from deposits and prepaid reservations, I suddenly looked and we had a bank account that had a couple million dollars in it — of forward money, like a lot of other businesses, like the computer business — where you buy a computer and they only ship it to you five days later. So we had a float! So I started calling up some of our big vendors for the big, expensive items — like proteins: meat, fish; luxury items: like caviar, foie gras, wine and liquor, and I said, “I don’t want net-120 anymore, I want to prepay you for the next three months.” And they had never had that kind of a phone call from a restaurant before.

You can see where this is going. The restaurant business is traditionally a cut-throat, low margin business. But with the magic of a float, Kokonas continues:

So how much should they discount it? So let’s say we’re going to buy steaks. We’re going to pay $34 a pound wholesale for dry aged rib-eye, we get net-120 (normally). So I call the guy and say “I’m going to use 400 pounds of your beef a week for the next 4 months, for our menu, which is about about $300,000 of beef, what (would) we get, if we prepay you?” And he was like “what do you mean?” I’m like “I want to write you a cheque tomorrow for all of it, for four months.” And he was like, “Well, no one has ever said that.” So he called me the next day, he said “$18 a pound” … so … half. Half price.

(Interviewer): Wow.

(Kokonas again): That’s what I said! I went, “I’ll pay you $20 if you tell me why.” And he said, “Well, it’s very simple. I have to slaughter the cows, then I put the beef to dry. For the first 35 days I can sell it. After 35 days there’s only a handful of places that would buy it, after 60 days, I sell it $1 a pound for dog food.” So his waste on the slaughter, and these animals’s lives, and the ethics of all of that, are because of net-120! Seems like someone should have figured this out! As soon as he said that, everything clicked, and I went “We need to call every one of our vendors, every time, and say that we will prepay them.”

The net result — Kokanas concludes: “we’ve managed to take our food costs down to a level that honestly, our chefs never thought was possible.”

Many of the games you play in business is centred around managing cash flow. This might seem bizarre — because a cash flow game is essentially taking the money you make, and moving it back and forth in time. Once you get this, however, you'll understand that raising capital is merely one instance of this game. Which probably means that if you want to reason from first principles, you'll have to start with cash flow in mind.

Raising Capital … From First Principles

There are only three ways to raise capital:

- You sell equity — e.g. on the stock market, or to angel investors or rich friends, or to venture capitalists.

- You take on debt — e.g. from banks, or insurance companies, or you may sell bonds, or issue notes or use some other debt instrument.

- You use retained earnings — that is, you take cash generated by the business and reinvest it back into the business.

Each of these three choices come with their own nuances. And I don’t mean a tiny bit of nuance, I mean that you can write whole books about each of these three options. There are differences in selling equity to an angel investor vs selling equity to a VC (vs setting up a joint venture, the primary method of conglomerate expansion in South East Asia) the same way there are nuances with taking on debt (Junk? SPVs? Convertible note? The list goes on).

But at least now you have all the right axioms in place. You have an intuitive understanding of cash flow, and you understand that raising capital is a consequence of the temporality of said flows. You know that some business models demand exorbitant amounts of up-front capital. You know that there are effectively only three ways to raise capital, and you understand that the decision to raise capital is really a function of your business model.

So let’s build up from first principles. If I were to make an argument about whether startups should or shouldn’t raise capital, I would say:

- Whether you should raise capital or not is a function of the cash flow characteristics of your business. What type of business are you in? What kind of business are you trying to build?

- This is both a values question (do you want to work your ass off or do you want to generate enough cash to buy you freedom?) and a business question (is your business very capital intensive? will your competition make your life extremely difficult if you are under-capitalised?)

- And finally: what pools of capital can you draw on? Most people in the startup world assume venture capital, because it is a default option. But VC is simply one option; capital comes in many forms. Do you have rich friends or family? Do you or your friends have access to a family office? Are governments more likely to fund you? Are you in a market where people are more willing to write you a loan than to invest in a new company? (Which is sometimes the case in Singapore.)

- To some degree, none of these questions can be answered until you’ve started executing, because only action produces information.

How First Principles Thinking Fails, Part 2

I’ve spent most of this essay on the nuances of cash flow, which is kind of a joke, given that the goal of this piece is to demonstrate how first principles thinking fails. But I wanted to give you a real world example, and the ensorial.com blog post happened to be the one essay that started it all.

So I guess the joke’s on me.

I think it’s worth asking at this point: what are the consequences of believing in a ‘less useful’ argument about the world? What happens if you read the ensorial.com’s argument as fact?

Well, for starters, it might mean being limited by your beliefs. It might mean chasing business ideas that have no hope of becoming successful, because structurally they call for external capital; it might mean ignoring alternative sources of capital, because they don’t fit into neat buckets like ‘VC’ or ‘angel’ or ‘venture debt’.

But of course it might not mean any of that. You could just as well bootstrap a tiny, successful internet business selling Wordpress plugins or Shopify themes, believing that ‘startups shouldn’t raise capital’. You would then never need to update your beliefs, because those are perfectly sufficient for a small, independently-run business.

And that’s fine.

Ultimately, we hold beliefs that are good enough for our goals. We only re-examine them when we discover that they no longer serve us in the pursuit of our ambitions. If the ensorial.com author achieves success with this belief; more power to them.

*

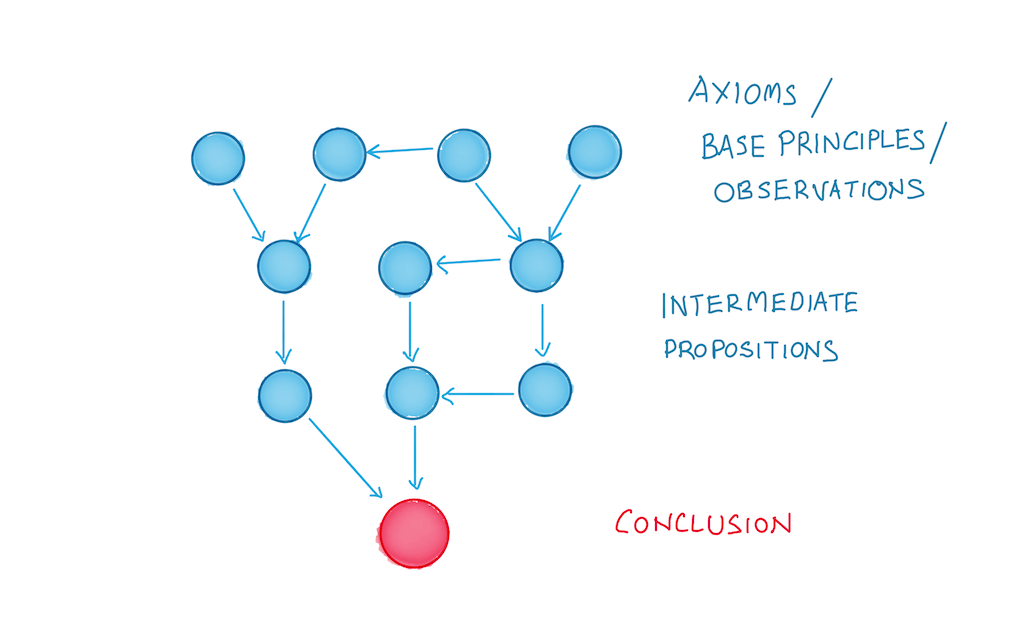

I’ve mentioned in my previous piece that the most pernicious form of failure for first principles thinking occurs when you start from an incomplete set of axioms. I argued that this was a pernicious because you cannot easily detect a mistake from the structure of your argument; you must observe reality to see how well your beliefs maps to practice.

I then (hopefully!) demonstrated this with this post: I explained that an understanding of cash flow is critical to any argument about capital. Not having that understanding is likely to hobble you when you build up an opinion from first principles.

There’s a meta question that’s implied by this entire essay, of course. The question is this: how would you know whether the first principles reasoning you’ve built up, from scratch, is right or wrong? In other words, how do I know this essay is right? This is a good question, and the honest answer is that I don’t. I’ve never raised venture capital. We tried to take on debt in my previous company, but every loan we were offered required us to sign a personal guarantee. (Yes, even the Singapore government-backed ones; I will never understand the logic there).

There may be whole axioms that I'm missing out on. But that’s par for the course.

In the end, this is exactly the point I’m trying to make. You never really know if your rigorously argued analysis is right; you always have to check for missed axioms during execution. And so I think the best thing that we can hope for is some form of “this analysis checks out, everything you say seems plausible, let’s wait and see.”

Which, reflexively, applies to this essay. Caveat emptor.

Originally published , last updated .

This article is part of the Capital topic cluster, which belongs to the Business Expertise Triad. Read more from this topic here→