This is Part 5 in a series on the expertise of capital in business. You may read the previous part here.

The capital cycle is a simple idea with a bunch of fairly profound implications. The basic form goes something like this:

- Capital is attracted to high-return businesses.

- The managers of these high-return businesses become drunk on growth, and expand production in response to their great success. This is rational! It makes sense to pursue growth when there are ravenous customers and large profits for the taking.

- There is a lag between this planned expansion and the actual supply in the market. It takes time to build factories, or to spin up new products. Nobody notices that future supply — across multiple competitors that are all expanding production — will soon outstrip demand.

- The new supply gradually floods the market, and returns fall below the cost of capital. Businesses slash prices to offload supply; company valuations collapse.

- Capital flees the sector because returns suck; companies close down or get bought out; consolidation occurs across the entire industry.

- This sets the surviving companies up for future excess returns.

The capital cycle is amongst the most basic patterns that you will find in finance, and one of its simpler ideas — perhaps second only in simplicity to the credit cycle. But of course the question that’s worth asking is: how do you exploit it? And I mean how do you exploit it as both an operator and an investor, for capital cycles occur in just about every industry. The implications for operators are trickier. As an investor, however, there is a dead-simple, first order, obvious conclusion: you observe the capital cycle for each industry, and invest only at the tail-end of consolidation. Unfortunately things are not as simple as this — there are nuances to investing through the capital cycle, and these nuances matter.

The book that most deeply explores the capital cycle is Capital Returns: Investing Through the Capital Cycle — a collection of analyst reports from Marathon Asset Management. The firm’s investment style is built around capital cycle analysis — as it turns out, there are plenty of interesting implications that flow from the core idea. This piece is a partial summary of the book.

At this point in the series, we’ve gotten a taste of various forms of Capital Expertise, but we’ve mostly examined methods of raising capital. We’ve yet to look deeply into examples of capital allocation, and we have not talked about the impact of Capital on the other legs in the business expertise triad.

Consider this piece an introduction to those topics. As you’ll soon see, I think the capital cycle makes for a good segue into the twin topics of capital allocation and broader capital expertise. This piece will open with some of Marathon’s investor-oriented ideas, and then switch to looking at the capital cycle from an operator’s perspective.

I think you’ll find these ideas simple. Their implications, however, are not.

The Investing Framework

Capital Returns is a collection of analyst reports from Marathon Asset Management, and it turns out that long-time Commoncog readers have encountered Marathon Asset Management before. We last examined the (slightly ridiculous) story of Nick Sleep and Qais Zakaria in Take a Simple Idea and Take It Seriously — which examines the history of their Nomad Investment Partnership. Sleep and Zakaria famously retired at age 45, after returning 921.1% to their investors over the course of 13 years. They cut their teeth at Marathon. Both men met whilst at the firm, and formed the first iteration of Nomad under the aegis of Marathon itself. They were amongst the writers who contributed to Capital Returns.

In the opening to the book, editor Edward Chancellor describes Marathon’s approach as follows:

The key to the “capital cycle” approach – the term Marathon uses to describe its investment analysis — is to understand how changes in the amount of capital employed within an industry are likely to impact upon future returns. Or put another way, capital cycle analysis looks at how the competitive position of a company is affected by changes in the industry’s supply side (emphasis mine). In his book, Competitive Advantage, Professor Michael Porter of the Harvard Business School writes that the “essence of formulating competitive strategy is relating a company to its environment.” Porter famously described the “five forces” which impact on a firm’s competitive advantage: the bargaining power of suppliers and of buyers, the threat of substitution, the degree of rivalry among existing firms and the threat of new entrants. Capital cycle analysis is really about how competitive advantage changes over time, viewed from an investor’s perspective.

The capital cycle is deeply tied to our discussion of competitive arbitrage, and the moats that you have to pursue if you want to resist it. But I should note that Marathon’s conception of the problem is slightly different from my (textbook) description of competitive arbitrage. I describe the problem as: “you make a lot of money doing X, which attracts the attention of other competitors, so they all follow you into X, and then they cut their prices, and then everyone suffers from a death spiral of price cuts, eventually resulting in shared shitty returns.” Marathon, however, reframes the problem as a problem of supply — and points out that you may arrive at the same conclusions if you just track the supply dynamics of a particular market. About which, more in a bit.

It’s worth asking why this cycle occurs. Surely this pattern, once described, becomes obvious and avoidable? Surely the capital cycle, in the hands of investors, becomes exploitable? But the cycle plays out over the length of years — sometimes decades — and the psychological factors are overpowering for both investors and operators alike. We’ll discuss investor misjudgments in a second, but perhaps it is easier to see why operators might succumb to cyclical pressures. When your competitors are all investing in growth, you cannot help but feel FOMO; when every other company in your sector is hiring big, or doing share buybacks at peak prices (and those prices consistently go up over the course of five, six, seven years) you follow suit because “well, it can’t be that bad, can it?” Chancellor’s introduction has this lovely section that lays out what it must feel like when you are in the midst of the cycle:

High current profitability often leads to overconfidence among managers, who confuse benign industry conditions with their own skill — a mistake encouraged by the media, which is constantly looking for corporate heroes and villains. Both investors and managers are engaged in making demand projections. Such forecasts have a wide margin of error and are prone to systematic biases. In good times, the demand forecasts tend to be too optimistic and in bad times overly pessimistic.

High profitability loosens capital discipline in an industry. When returns are high, companies are inclined to boost capital spending. Competitors are likely to follow – perhaps they are equally hubristic, or maybe they just don’t want to lose market share. Besides, CEO pay is often set in relation to a company’s earnings or market capitalization, thus incentivizing managers to grow their firm’s assets. When a company announces with great fanfare a large increase in capacity, its share price often rises. Growth investors like growth! Momentum investors like momentum!

Investment bankers lubricate the wheels of the capital cycle, helping to grow capacity during the boom and consolidate industries in the bust. Their analysts are happiest covering fast-growing sexy sectors (higher stock turnover equals more commissions.) Bankers earn fees by arranging secondary issues and IPOs, which raise money to fund capital spending. Neither the M&A banker nor the brokerage analysts have much interest in long-term outcomes. As the investment bankers’ incentives are skewed to short-term payoffs (bonuses), it’s inevitable that their time horizon should also be myopic. It’s not just a question of incentives. Both analysts and investors are given to extrapolating current trends. In a cyclical world, they think linearly.

Operators who haven’t been around for a bit — or who haven’t spent time dredging history for patterns — will not be able to recognise the structure of the cycle when they are in the midst of it. But of course this isn’t enough. Having some knowledge of the capital cycle is one thing. Acting in a way that is resilient to it is another. Managers who run businesses in industries with particularly quick and vicious capital cycles — such as in semiconductors, to take one quintessential example — tend to act with more awareness of the cycle. And for good reason: in such industries, the operators who aren’t aware of the cycle tend to get slaughtered.

But what of investing in the capital cycle? Here the book excels. Marathon walks you through the implications of their one idea, layering on lenses that make the approach more interesting and more useful than it first appears.

Supply Analysis is Easier

Capital Returns is widely regarded as part of the modern canon of value investing, and it is usually remembered for one novel argument, made in the first quarter of the book. Marathon argues that capital cycle analysis is essentially the art of reasoning about industry supply, and this is good because it is much easier to predict supply, compared to predicting demand.

The vast majority of investment analysis attempts to predict demand. Observe, for instance, the number of analyst reports forecasting iPhone sales for the next quarter. Demand questions are of clear value, but are extremely difficult to answer: as you might imagine, demand may be affected by a gajillion unexpected things. By contrast, predicting supply is comparatively easy. The analyst may track capital expenditures across the entire industry, listen carefully to management for expansion plans, and then do back-of-the-napkin math to predict when new production might come online.

Watching supply instead of demand also enables investors to avoid so-called ‘value traps’ — that is, companies that look cheap from a valuation and financial-ratio perspective, but are, in reality, still suffering from an overhang of excess supply in their respective markets. Marathon points out that one such example are US housing stocks in the lead-up to the global financial crisis: homebuilders may look undervalued, until you consider the glut of housing supply on the market.

This leads us to a second question: if the capital cycle is an old idea, why do equity mispricings continue to occur? Marathon argues that the market displays two kinds of systematic behavioural bias:

- The market consistently overestimates the ‘fade rate’ of high returns for a high growth company with good moats, because it does not adequately price in the company’s ability to keep out supply in its market.

- The market consistently underestimates the strength of a company that survives the bottom of the capital cycle; it does not adequately price in the higher returns the company will enjoy in an environment where most of its competitors have died or consolidated.

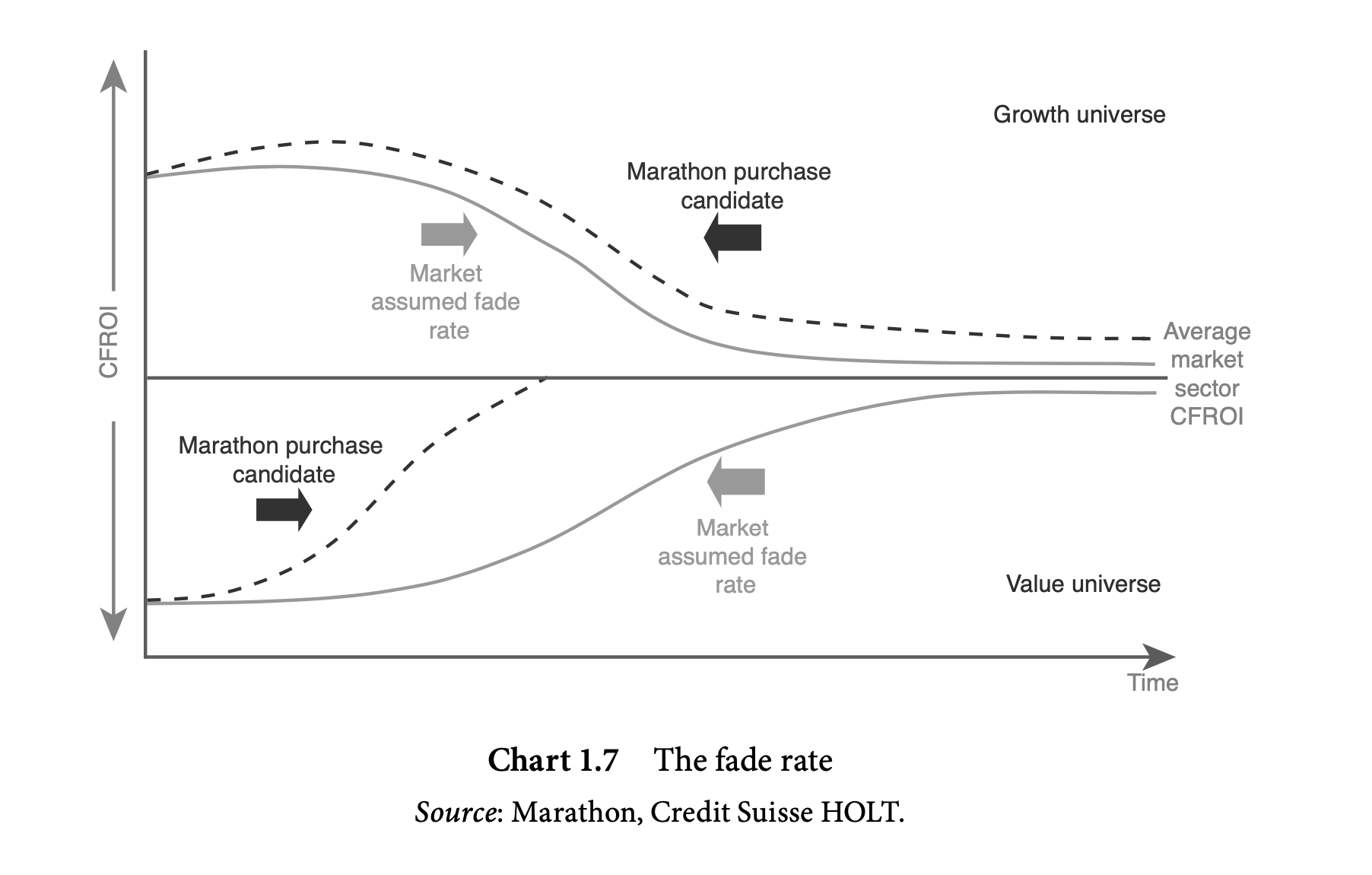

Marathon borrows this idea of a ‘fade rate’ from Holt Value Associates, and argues it applies to both sides of its capital cycle analysis:

Using this framework, two purchase candidates are identifiable. Purchase Candidate A is a company capable of sustaining high returns beyond the market’s expectation (the upper dotted line) — that is, the company remains above average for longer than average. Candidate B is a company which can improve faster than the market generally expects (the lower dotted line).

Marathon’s experience suggests that the stock market is often poor at pricing superior fade characteristics. For Purchase Candidate A, mispricing stems from a number of sources. One is the underestimation of the durability of barriers to entry. Another is the underappreciation of the scale and scope of the addressable market. Management’s capital allocation skills are also often overlooked. A recent meeting with the CEO of Bunzl, the leading specialist business-to-business distributor, was instructive in this regard. While sell-side analysts covering the stock have made reasonably accurate forecasts of returns from the core business, they have consistently failed to give management credit for adding value via bolt-on acquisitions, despite 20 years or so of supporting evidence. Investors also appear to be biased against “boring” high return companies, such as Bunzl, which do not offer the prospect of immediate high share price appreciation.

The conditions leading to Purchase Candidate B often stem from the market misjudging the beneficial effects of reduced competition as weaker firms disappear, either through consolidation or bankruptcy. Alternately, an unruly oligopoly may tire of excess competition and enjoy an outbreak of peaceful coexistence. The turn in the capital cycle often occurs during periods of maximum pessimism, as the weakest competitor throws in the towel at a point of extreme stress. When the pain of losses coincides with a depressed share price, investors can find wonderful opportunities, particularly if they are willing to take a multiyear view and put up with short-term volatility.

Management skill at dealing with problems may also be overlooked. This is especially true when a new leader is recruited externally, maximizing the possibility of change.

If the first idea — on underestimating a ‘fade rate of returns’ due to a misjudgment of a company’s moats — sounds a lot like straightforward value investor defensibility / Hamilton Helmer ‘Power’-style analysis, than you’d be right. The novel thing that Marathon contributes here is really its focus on the supply side of the market. Supply-side analysis, it seems, will naturally highlight companies that appear resistant to the capital cycle … and if you take a closer look at such companies, more often than not you’ll get some kind of ‘moat’.

(It is a useful intellectual exercise to go through the book and categorise each example in terms of one of the 7 Powers, but that is perhaps an exercise left for another day).

Tacit ‘Collusion’

Embedded in the snippet above lies another lens that Marathon uses: that of watching for an ‘outbreak of peaceful coexistence’.

As an operator, I find this description compelling, and actually useful — at least as a description of industry behaviour. I’ve long wondered what cyclical companies look like ... especially when they have no moat. The simplest model I have in my head is that business is good for a period, and then everything goes to shit thanks to competitive arbitrage. But thousands of businesses are exposed to such cyclical pressure: mining, farming, semiconductor fabrication, steel. What if you were stuck inside one such company, and you … hung around? Marathon tells us that a period of high returns is possible after the bottoming out of the cycle … assuming that a number of things happen first.

How does this work? When Marathon seeks to invest at the bottom of a capital cycle, the firm checks that the following conditions are present:

- That a small number of large players evolve from a situation of excess competition and suddenly exert ‘pricing discipline’. This occurs when the managers of the respective companies are all tired of war and are motivated by balance sheet repair. “Having a small number of players is important,” Marathon writes, “since retaliation (say a price cut) is likely to be a more powerful weapon in the hands of a dominant price setter.” The authors appear reluctant to write what they mean, so I’ll just say it outright: outsized returns only emerge when there is tacit collusion between companies. Collusion is perhaps too strong a word, but it is illustrative: when there are no moats, businesses do better when they aren’t at each other’s throats. This tacit ‘collusion’ seems to be what Marathon is hunting for, in the rubble at the bottom of a capital cycle.

- The conditions for tacit ‘collusion’ are interesting to work through. Marathon argues that ‘tit-for-tat’ peace arrangements must be sufficiently legible to all market participants. What this actually looks like depends on the industry, of course. They write that, for instance, “the auto industry (has) too much noise in everyday competitive battle. Carmakers have to decide not just on price, but also on specification, customer financing terms, new model launches, service and warranty terms, etc, leading to the paradoxical conclusion that product differentiation can be an impediment to achieving supernormal returns (emphasis mine). Contrast this with the steel or paper producer, whose product is relatively undifferentiated.”

- Marathon also argues that price setting should be done centrally, with relatively low transaction frequency: “in the airline industry, decisions on pricing have been devolved to front-line managers, creating a competitive battleground akin to death by a thousand cuts. Again, contrast this with an industry such as the automotive glass industry in Europe, where the three remaining participants enjoy long-term supply agreements and infrequent decisions on new capacity that are signalled clearly in advance.” That would make tacit collusion easier, wouldn’t it (wink, wink)?

- The overarching point isn’t that high product differentiation or high transaction frequency prevents companies from coming to tacit collusion; only that they make it harder to do so. The point is that there should be a plausible path to tacit collusion. If none exists, then it’s likely that a period of high returns will never emerge despite all the devastation of the capital cycle!

- But tacit collusion, Marathon argues, is not enough. There must also be barriers to entry, so that opportunistic new entrants are unable to take advantage of the price umbrella. It is for this reason that globalisation is a problem for Marathon’s analysts — sure, steel manufacturers in the West may finally sue for peace … only to be punched in the face by a supply glut originating from China.

- Finally, and perhaps most importantly, politicians ‘should not hinder’ the operation of the capital cycle. It is this point that seems to irk Marathon the most. At the tail end of the capital cycle, weak companies ideally close down or consolidate — paving the way for future returns for the survivors. But governments are sometimes incentivised to prop up bad companies — perhaps by lending them cheap money, or by keeping interest rates low for an extended period. Whenever these things happen, the capital cycle takes much longer to play out, and Marathon finds no opportunities for return.

To summarise, Marathon writes: “a basic industry with few players, rational management, barriers to entry, a lack of exit barriers (that is, government erected policies to prevent companies from dying or consolidating), and non-complex rules of engagement is the perfect setting for companies to engage in cooperative behaviour. It is relatively easy to identify those industries where these conditions exist currently (just look at existing returns on capital), and it is for this reason that the really juicy investment returns are to be found in industries which are evolving to this state. The joy from a capital cycle perspective is that most investors are, for a variety of behavioural reasons, taken by surprise. Across many competitive battlefronts, we are always looking out for the next outbreak of peace (emphasis mine).”

Two Forms of Application

It takes a handful of pages before you realise that Marathon’s presentation of its ‘fade rate’ framework is really a statement of application: there are two ways to apply the capital cycle framework. The first approach is to invest at the turn of the capital cycle, as we’ve just discussed. The second approach is to analyse companies that appear to be protected against the cycle, perhaps due to some defensibility of supply built into its market.

It takes a hundred more pages before you learn that one style of application has stopped working in years leading up to the book’s publication. In Chapter 5, Marathon writes, somewhat unhappily:

The capital cycle ceases to function properly when politicians protect underperforming industries. (…) With hindsight, our capital cycle approach has failed at times when we have underestimated the impact on industries of political and legal interference, disruptive technologies and globalisation.

To this list of external factors, one can add the self-inflicted wounds of mismanagement. The most common problem is the failure of capital to exit industries with unacceptably poor returns. In the latest cycle, the forces of creative destruction have been moderated by aggressive monetary easing and low interest rates. This has allowed weak firms to continue in business, servicing what are likely to prove unsustainable debt levels. This situation contrasts with the end of previous economic cycles when interest rates have risen to stave off inflationary pressures leading to mass bankruptcy. (…)

New technologies often interfere with the smooth operation of the capital cycle (emphasis mine). The Internet has wreaked havoc on many industries, including music, regional newspapers, book retailing and travel agencies. Marathon has suffered in a number of cases where the benefits of supply side consolidation in distressed sectors was insufficient to offset a secular decline in demand. Fortunately, the capital cycle approach is well attuned to identifying superior Internet business models which can sustain high returns of capital. (In a footnote: “An allusion to Marathon’s unsuccessful investments in companies with strong incumbent positions but whose business models did not survive into the digital age. They include a CD retailer (HMV), a photo equipment manufacturer (Eastman Kodak), a video rental firm (Blockbuster) and a music business (EMI).”)

(…) In recent years, capital cycle analysis has been more useful at picking stocks in companies which can maintain high returns than in finding opportunities among bombed-out industries recovering (or not) after a supply side restructuring. For the former, the investment case rests on whether competing capital can enter the sector and boost supply, eventually driving down industry returns. What we have seen in a number of cases is that dominant businesses often become more powerful when they have well managed, proprietary assets. Examples here include Nestlé, Unilever, and McDonald’s. It has helped that the durable cash flows generated by such businesses have the bond-like characteristics investors crave in the current environment of low interest rates.

In short, the great strength of the capital cycle approach lies in its adaptability. The basic insight doesn’t change. Namely, both high and low returns are likely to revert to the mean as valuation influences corporate behaviour and brings about shifts in the supply side. In Marathon’s early years, our discipline was focused on finding stocks where the supply conditions were changing. More recently, the emphasis has shifted to identifying sectors and companies where the forces of competition are blunted and the process of mean reversion is drawn out.

Marathon spends a large chunk of the book going through examples of companies that appear to never be threatened on the supply side. This is — as we’ve discussed elsewhere — what it looks like when you have a moat. And so you can sort of squint and take Marathon’s two approaches to the capital cycle and invert it for management:

- Either you run your business, fully cognisant of the capital cycle, taking care to never overstretch yourself in times of excess, setting aside resources for a rainy day (so that, presumably, you can swallow up your competitors in periods of consolidation).

- Or you find moats, such that the effects of the capital cycle are muted in your business.

Ideally you do both; the two approaches are easier with some knowledge of the cycle.

The Operator’s Perspective

Commoncog is primarily written for the operator, so why have I spent nearly 4000 words walking you through an investing framework?

The reason, as you might have already guessed, is that at the highest levels of business some investing skill is necessary for supernormal returns. Marathon dedicates one full chapter to managers who are particularly savvy at navigating the capital cycle, and opens that chapter with:

Like many other investors, Marathon never tires of quoting Warren Buffett. One particular comment of the Sage of Omaha has become something of a mantra at the firm: namely, Buffett’s observation that “after ten years on the job, a CEO whose company retains earnings equal to 10 per cent of the net worth will have been responsible for the deployment of more than 60 per cent of all capital at work in the business” (emphasis mine). What this means is that investors should pay particular attention to the capital allocation skills of management.

As Marathon’s investment holding periods became more extended, in contrast to the fund management industry as a whole, the notion that a manager’s skill in capital allocation is decisive to the investment outcome has been reinforced. The study of management, via face-to-face meetings and general observation, has become one of the main elements of the daily job at Marathon. The case of Björn Wahlroos of Finland’s Sampo, outlined in this chapter, shows how the ideal corporate manager is one who understands his industry’s capital cycle and whose interests are aligned with those of outside investors.

The Sampo Story

Let’s talk about ‘Björn Wahlroos of Finland’s Sampo’ for a moment.

Sampo is a Finnish financial services group. This is notable for two reasons: first, financial services is an inherently cyclical sector; second, financials are a type of business where capital expertise is critical. Marathon writes: “Financial companies are probably the most challenging of all for CEOs to manage, as they require many more capital allocation decisions compared with, say, running a large food retailer or consumer products company.” An ominous note, perhaps.

Björn Wahlroos arrived at Sampo in 2001, after selling Mandatum — his boutique investment bank — to the group for €400m. This was a 100% equity deal, with Wahlroos’s 30% holding in Mandatum turning into a 2% stake in Sampo. As part of the sale, Wahlroos stepped up to become CEO of the larger financial group.

At the time, Sampo operated three major domestic businesses: a bank, a property & casualty (P&C) insurance business, and a life insurance business. The group also owned around 1% of Nokia’s outstanding shares, making up €1.5bn or 22 per cent of Sampo’s net asset value. Almost immediately, Wahlroos began selling down this stake — bringing the group’s ownership from 35m shares to 6.7m shares, at about an average price of €35 a share. Nokia’s share price collapsed but a few months later.

Wahlroos then turned his attention to Sampo’s P&C insurance business. At the time, the business was ‘essentially mature’ — it held 34% market share in Finland’s domestic market and had little headroom for growth. Wahlroos injected this business into a pan-Nordic P&C business named ‘If’, in exchange for a 38% ownership stake (and half the voting rights), along with €170m in cash. ‘If’ controlled 37% market share in Norway, 23% in Sweden, and 5% in Denmark. I’m not entirely sure if Sampos had a direct say in management, but ‘If’ quickly introduced pricing discipline (cough: oligopolistic pricing), and began reducing their combined ratio from 105% to 90% over the course of four years. (The combined ratio is the sum of incurred losses and expenses divided by earned premium. A combined ratio of > 100% indicates an underwriting loss; below 100% indicates an underwriting profit).

In 2003, before ‘If’’s combined ratio hit 90%, Sampo took full advantage of the financial distress of its partners and bought out 100% of the equity at an implied valuation of €2.4bn. ‘If’ hit 90% combined ratio in 2005; in 2010, a mere five years later, the lowest valuation of insurance group was €4bn. Sampo paid a fraction of that for an asset that had essentially doubled in value; in 2010 Wahlroos began trumpeting an open invitation for a sale of ‘If’ … for €8–9bn.

Wahlroos’s next big move came in 2007, right before the global financial crisis. Sampo announced the sale of its Finnish retail banking business to Danske Bank, at top-of-market prices (€4.1bn). Financial sector valuations collapsed a few months later. Wahlroos took this cash and slowly built up a 20% stake in Nordea — the largest Nordic banking group, and a higher quality retail bank — right out of the depths of the financial crisis. Marathon notes, approvingly: “Sampo have now invested €5.3bn in Nordea at an average price of €6.39 per share, which compares with the current price of €7.70. Almost half of the position was acquired at a price of around 0.6 times book value, implying an impressive arbitrage compared with the 3.6 times book value achieved on the sale of the Finnish business.”

As impressive as that was, Sampo’s greatest capital allocation move came right before the Lehman bust. Wahlroos decided to sell down the weighting in equities down to 8% of Sampo’s investment portfolio, keeping its position in liquid, fixed income assets. As a result, Sampo had so much cash lying around that it was able to buy €8bn–€9bn in commercial credit in the autumn of 2008, purchased at fire sale prices from distressed sellers. Two years later, the bonds have yielded a €1.5bn gain.

Marathon Asset Management closes out a case study of Sampo with the following paragraph:

As a result of these astute capital allocation decisions, the Sampo share price has comfortably outperformed its financial services peer group and has outperformed the overall European stock market by a factor of nearly 2.5 times since January 2001. The Sampo case study combines many of the key elements that we look for in management; namely, it has a chief executive who both understands and is able to drive the industry’s capital cycle (the Nordic P&C consolidation story), allocates capital in a counter-cyclical manner (selling equities prior to the GFC), is incentivized properly (large equity stake) and takes a dispassionate approach to selling assets when someone is prepared to overpay (Finnish bank divestment). The pity is that there are so few examples of Sampo-esque management elsewhere in Europe.

If all of this activity sounds like investing, that’s because that is what it is. Granted, Sampo is a financial services company, which means Wahlroos’s actions are necessarily more capital allocation than anything else. But it’s worth noting that even regular companies have to make investment-type decisions with the cash generated from their businesses. This is the point of Buffett’s quote: “after ten years on the job, a CEO whose company retains earnings equal to 10 per cent of the net worth will have been responsible for the deployment of more than 60 per cent of all capital at work in the business”.

Over the long term, a significant amount of company value creation is determined not by operating decisions, but by capital allocation decisions.

This is more difficult than it first seems.

Common Mistakes

Compare Sampo’s story with the vast majority of companies in Marathon’s investible universe. The analysts write:

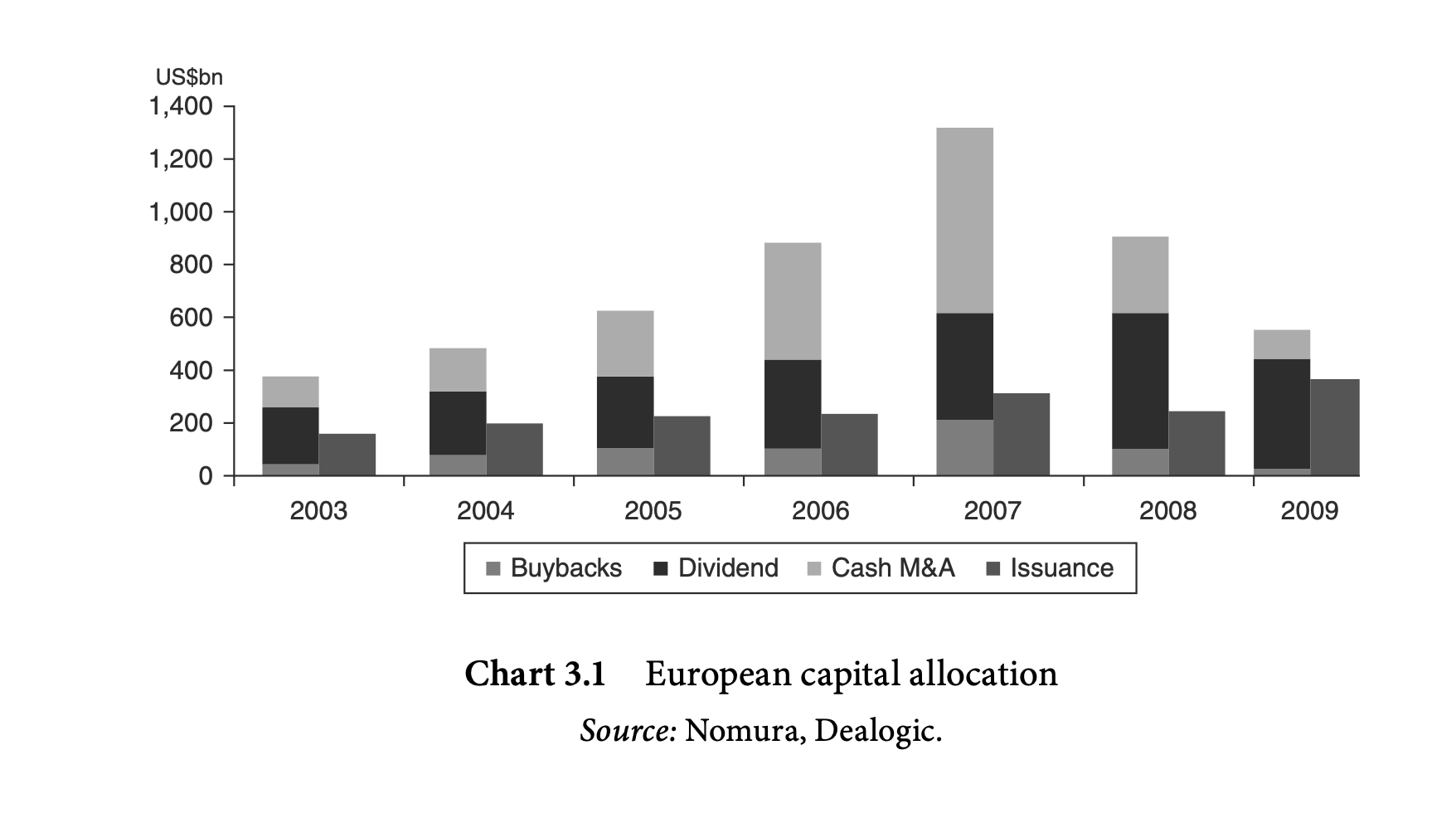

It remains one of the great mysteries of corporate behaviour, why companies tend to buy high and sell low, even when this involves their own equity. This has been very much the case over the last few, tumultuous years. As the markets climbed towards their 2007 highs, companies spent a record amount on acquiring overvalued equity through cash-based M&A transactions and buybacks, as Chart 3.1 shows. Although equity issuance also reached a peak level, one suspects most of that was used to purchase overvalued equity in other companies. This was certainly the case with the €19bn Fortis rights issue, which funded the purchase of certain parts of ABN Amro, and the Veolia equity issuance of some €3bn at the top of the market, which was used to purchase assets that were clearly overvalued (if the subsequent 66 per cent decline in Veolia’s share price fall is anything to go by).

The herd-like behaviour of companies and their managements never loses its power to astound. All too often, when one company decides that buybacks are the thing to do, then its competitors will play the game too. By the same token, capital raising (secondary issues) often appears at the same time among multiple companies in the same industry. One reason they act together is that no company wants to see competitors gain a funding advantage. For instance, European building material groups — including Holcim, Lafarge and Saint-Gobain — raised a total of nearly €10bn around the market low in early 2009, having been marginal repurchasers of their equity in 2008. These same companies invested heavily at the top of the cycle, spending a phenomenal €46bn in the 2005–08 period, before making disposals of €9bn in 2009.

A more nuanced reading of Sampo’s story is in order. It’s not enough to say “oh, take counter-cyclical actions.” The difficult thing is how. If your business is cyclical in nature, you are — by definition — going to be cash rich when everyone else is rich, and cash poor when everyone else is poor. The real question, worth asking — which is on display throughout the Sampo case study above — is how to be cash rich when everyone else is poor. It’s really only in this manner that you may strengthen your hand whilst everyone else is suffering.

Wahlroos’s solution seemed to be to sell pieces of his business at peak market prices, and then to sit on cash until he could redeploy at the bottom of the market. Once you are aware of this pattern (that cyclical companies who do the best seem to be the ones who take advantage of their sector cycle) you start spotting it in all sorts of places. I am reminded of (privately owned) Koch Industry’s penchant to use as little debt as possible, and to pay down whatever debt incurred in acquisitions as quickly as they can, so that the considerable cash flow they generate may be redeployed whenever the commodity cycle turns (Koch is in oil, so cyclicality is big part of the shape of the game they are playing). And I am reminded, also, of Henry Singleton, who ran the conglomerate Teledyne from the early 60s through the early 90s. Singleton sold equity during the 1960s conglomerate boom in order to fund acquisitions of fairly valued, high cash flow companies. This was only possible because conglomerates were — at the time — overpriced; valuations for single-business companies stayed at much lower P/E ratios compared to the conglomerates that purchased them. Over the course of the 1960s, Singleton purchased 130 companies in a variety of industries, buying all but two of them with overpriced Teledyne stock, much of which was newly issued through the decade. Then, when the boom ended in 1969, Singleton shut down his acquisition team, systematically increased the cash flow of each of the purchased subsidiaries, and bought back 90% of Teledyne’s outstanding shares over the course of 1972 to 1984.

In each of the above examples, it is easy to look back and go “that was a well placed, savvy capital allocator.” Buffett and Munger, in particular, are very effusive in their praise for Singleton (“No one has ever bought in shares as aggressively,” said Munger to Will Thorndike, in a 2004 interview conducted for Thorndike’s 2012 book The Outsiders, “[Teledyne’s results are] miles higher than anybody else … utterly ridiculous.”)

But if you dig into these stories carefully, and if you paid attention to the conditions around their counter-cyclical moves, you might walk away with a slightly different picture: these actions were psychologically difficult to do. Think about it: Wahlroos selling Sampo’s domestic banking business at the height of the boom is easy to describe as ‘prescient’ now, but at the time it must’ve been seen as a loser’s move. One could imagine insiders sniggering: “Wahlroos is tapping out of a ‘rising sector’, giving up on ‘an amazing growth opportunity’, putting Sampo in a worse competitive position against its financial sector peers.” It would seem, to the average business observer, that Sampo was stepping out of the arena; quitting against the ‘big boys’ playing in the ‘big leagues’. Ditto for Koch, or for Singleton. For Koch, being disciplined with debt deployment is another way of saying “not doing the biggest deals in the industry”; for Singleton, “never paying more than 12 times earnings” meant that for a 10 year period — and possibly longer — Teledyne was always overshadowed by flashier acquisitions, made by larger conglomerates. And think about that for a moment. Think about the press Teledyne must’ve been getting. Imagine the comparisons that must’ve been written about Singleton and the other conglomerate kings of his era — if any such comparisons were even done. A dismissive “Teledyne is just a two-bit player” isn’t that much of a stretch to imagine — in Robert Sobel’s The Rise and Fall of the Conglomerate Kings, for instance, Teledyne only merits a passing remark (and even then, in the context of conglomerate king Tex Thornton, Singleton’s former boss).

With Marathon’s investing framework, it becomes slightly easier to see why capital expertise is necessary at the latter stages of business. Consider the statement “Wahlroos sold Sampo’s Finnish retail banking business to Danske Bank, at top-of-market prices (€ 4.1bn)” or “Singleton paid for acquisitions with overvalued Teledyne stock.” Embedded in these statements is a fact: Wahlroos and Singleton had internal valuation models of their businesses. That, coupled with their moves in response to the capital cycle, tells me that they had a keen sense of their companies's intrinsic value. This ‘keen sense’ is not, if you think about it, commonly described as an operator skill.

I particularly enjoyed this Singleton exchange, taken from The Outsiders:

In early 1972, with his cash balance growing and acquisition multiples still high, Singleton placed a call from a midtown Manhattan phone booth to one of his board members, the legendary venture capitalist Arthur Rock (who would later back both Apple and Intel). Singleton began: “Arthur, I’ve been thinking about it and our stock is simply too cheap. I think we can earn a better return buying our shares at these levels than by doing almost anything else. I’d like to announce a tender—what do you think?” Rock reflected a moment and said, “I like it.”

You can’t call a stock ‘too cheap’ if you don’t know how to value companies. Singleton may have cut his teeth as an electrical engineer, and then as an operator under Litton Industries … but at Teledyne, he was an investor at heart.

Wrapping Up

So what have we learnt together?

At the top of this essay I introduced a new concept in the capital leg of the triad: the ‘capital cycle’, and then walked you through the implications of the cycle from both an investing and an operator standpoint. It is likely that you will not be able to unsee the cycle after reading this essay — which if so, yay, good, I am happy to know that you are afflicted with the same disease that I have.

I should note that I’ve left out nuances of Marathon’s framework, as I am not an investor, and Commoncog is not an investing blog. But it also pains me to admit that at some point, I may need to become one. The overarching lesson of this essay is that over the long term, supernormal returns in a business is highly determined by capital allocation skill. And capital allocation is nearly always the CEO’s job. That’s a sobering fact to consider.

I’d like to set aside the investing theory for a moment to talk about the business implications. (If you are an investor, or have investing tendencies, I recommend reading Capital Returns in full. This essay is not enough to do the book justice if you want to use capital cycle analysis to invest; it is, however, enough if you want to use it as a business operator).

As businesspeople, what can we learn from Marathon’s work?

I’ve already mentioned the biggest overarching lesson (that of investing skill being necessary for good long term business returns). The next biggest idea is likely the two-prong application of Marathon’s framework:

- If you are running a cyclical business, the path to winning is to never be the biggest top-of-cycle winner, to not get caught up in the mania and to find ways to survive and consolidate when the cycle finally turns. More often than not this means playing investor-type games with businesses you own. So perhaps the actionable thing here is to own multiple businesses, and then learn to become a good capital allocator? (A caveat: I am actively looking for good examples of well-run cyclical businesses that are not conglomerates; I’ll update this takeaway if I find good counter examples. Unfortunately, pretty much everything I’ve read about good cyclicals seem to be this sort of ‘multiple businesses, portfolio approach’ type of company — with some moats. Is there an alternative model that works? I don’t know, but I’ll find out.)

- If you don’t want to suffer from the full effects of the capital cycle, go build some moats — and on this topic I think Marathon’s ideas illuminate the 7 Powers framework in complementary ways. The Powers are important because they limit competition — and limiting competition is important because it limits supply.

The third most important idea, I think, is that awareness of the capital cycle is a foundational part of capital expertise, and such awareness is necessary for long term business excellence. An operator with total focus on Operations and the Market would be completely blindsided when the capital cycle in his or her industry turns; I think by this point, you can see how bad capital allocation decisions in the mania of a cycle can put you in a bad position against a competitor run by a better allocator.

One final note. I will say that the biggest impact that Capital Returns has had on me is this sense of “here’s what the game looks like when you’re dealing with a cyclical business.”

I think this is useful. It is too easy to say “oh, just get out of cyclical businesses” or “go build a moat!” — as if the average business owner is able to so radically change the businesses he or she is in. And, ok sure, yes, over the long term this is possible — you can build a moat to blunt the effects of supply in a cyclical industry, and you can evolve your business out of cyclicals. In fact both of these moves show up in the story of Danaher, a conglomerate that shifted their business composition from cyclical industrials to more desirable healthcare businesses over the course of three decades.

But what if you work in a cyclical industrial? What if you were one of the managers that Danaher left behind at Fortive — the holding company for all its old industrial businesses? For the vast majority of late career operators, jettisoning out of a cyclical business that you are good at is not a real choice. So, yes, go get a moat (and Fortive has one) — but Marathon’s ideas give you a better sense of the financial forces acting on your business. I think that gives you a route to winning.

This is Part 5 in a series on the expertise of capital in business. You may read Part 6 here: Building a Valuable Business? It's How You Spend It That Matters.

Originally published , last updated .

This article is part of the Capital topic cluster, which belongs to the Business Expertise Triad. Read more from this topic here→