In Singapore, and Malaysia, and India, and Vietnam, if you’re a young software engineer fresh out of college, you have effectively three choices for a first job:

- You can go work for a product company, one where the tech is the focus. This is most likely a startup. (Unlike in Silicon Valley, there are rather limited opportunities for established tech companies in these countries).

- You can go work in the IT department of some non-tech company, like Bosch, or Citibank, or AIA.

- Or you can go work for an outsourcing / professional service firm.

That last option is a really big one. A large portion of tech company jobs I know in Vietnam, Singapore and Malaysia come from some consulting firm. Those firms exist on a spectrum. At the bottom are the pure outsourcing companies — the ones that treat its employees like so much gristle to be fed to a meat grinder. At the top are the premier consulting companies — the Pivotals and the East Agiles of their respective markets. And there are, of course, a plethora of consulting firms in between; I know more than a dozen friends who have elected to start consulting firms. I even ran one for a year.

All of this is to say that I’m just really, really interested in the business of consulting. And I think I should be: in Asia, software consulting continues to make up a large proportion of tech jobs. You simply can’t ignore them if you work in the industry.

(The same goes for accounting and law and media, financial advisories and estate planning and ad agencies, real estate brokers and PR firms and investment banks. There are whole industries where the primary employer is a professional service firm).

Professional service firms are interesting businesses. They don't own assets. They own labour. They don't manufacture things (for the most part). They charge a multiple of their people’s time costs. As a result, they have very different takes on profitability, company growth, and employee retention. If you want to work for one, you damn well better know how they work.

I was faffing around on Goodreads three weeks ago when I stumbled upon David Maister’s Managing the Professional Service Firm. Maister was a former Harvard Business School professor and consultant; Managing the Professional Service Firm was written as a series of articles over the course of the 80s — the majority of which were published in American Lawyer.

Maister’s book is incredible. The first two chapters lay out the underlying principles of a professional service business. The rest of the book examines the second and third-order implications of those principles — and form the basis of a highly effective agency management style.

I want to summarise the first two chapters of Maister’s book here. I can’t do more than that; Maister’s book is a 🌳 tree book, which makes it impossible to summarise. But I think the core principles are worth writing about — if you’re considering a job in a professional service firm, you’ll probably find these two chapters the most useful.

Maisters’s Core Thesis

Maister’s core thesis is this:

Professional service firms must be managed differently from industrial and mass-consumer businesses. This is due to two reasons. First, professional service firms perform highly customised work. This makes the application of product management (or manufacturing) principles a bad fit for them.

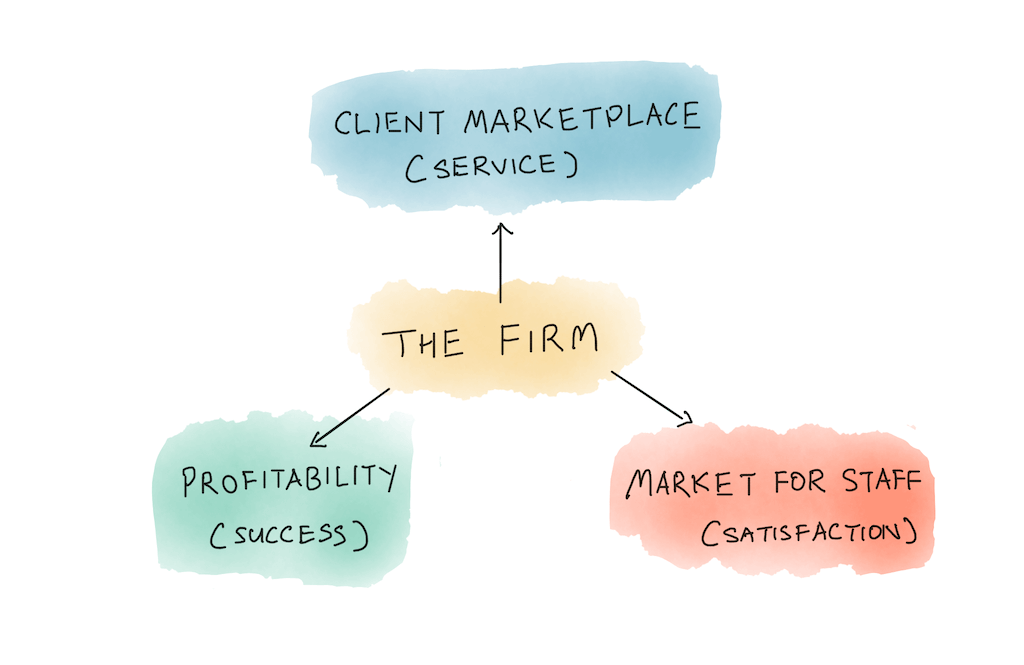

Second, professional service firms require a healthy component of face-to-face client interaction. The top performers must have special client-facing skills, which in turn places a heavy burden on the firm to recruit and train the best people in your field with such client-management skills (if you’re familiar with Joe Average Programmer, you should know that this is a lot harder than it sounds). In turn, this forces the professional firm to actively compete in two markets: the ‘input’ market for talent, and the ‘output’ market for its services.

Maister writes:

… while it is clear that the management problems of professional firms are sufficiently different from industrial or mass-consumer businesses to require their own “management theory”; it is also clear that, in spite of many differences, businesses within the professional service sector face very similar issues, regardless of the specific profession they are in. When I began my work, I treated these propositions as hypotheses. Ten years, many professions, and countless firms later, I take them as confirmed facts.

My thesis is that an understanding of underlying business models leads to better career decisions. So. What does that ‘management theory’ consist of?

All Professional Service Firms Have The Same Mission

The first is Maister’s observation that all professional services firms seem to have the exact same mission:

“To deliver outstanding client service; to provide fulfilling careers and professional satisfaction for our people; and to achieve financial success so that we can reward ourselves and grow.”

It doesn’t matter if the firm is large or small, if it’s located in America or Japan, or if it’s investment banking or law. The words of the mission may differ but the meaning is essentially same.

It’s no coincidence that these three goals are so universal to professional service firms. As it turns out, such firms must balance between the demands of the client marketplace, the realities of the talent marketplace, and the firm’s economic ambitions if they are to survive.

What this means, exactly, will become clear in a minute.

The Most Important Managing Decision is the Firm’s Leverage

When in pursuit of the three goals, the most important factor the firm must manage is its ratio of junior, mid-level, and senior staff members in the firm’s organisation. Maister calls this ratio the ‘leverage’ of the firm.

The archetypical professional service firm consist of three levels. They’re often called ‘grinders’, ‘minders’, and ‘finders’. This is true for law firms (associate, junior partner, senior partner), management consultancies (junior consultant, manager, vice president), investment bankers (analyst, associate, vice president, director — though analysts don't really count) and so on.

The ratio of junior, mid-level, and senior staff members make up the ‘shape’ of the firm — and the shape of the firm should be determined by the skill requirements of the work it does.

Maister points out that there are three ‘types’ of client work (in reality, as with most things, these points exist on a spectrum). The client work is determined by the market, but the mix of project types is up to the firm.

I’ve mentioned this in my previous post on business models, but here it is again:

- Brain projects. “In the first type (Brains), the client’s problem is at the forefront of professional or technical knowledge, or at least is of extreme complexity. The key elements of this type of professional service are creativity, innovation, and the pioneering of new approaches, concepts or techniques: in effect, new solutions to new problems. The firm that targets this market will be attempting to sell its services on the basis of the high professional craft of its staff. In essence, their appeal to their market is, “Hire us because we’re smart.”

- Grey Hair projects. “Grey Hair projects, while they may require a highly customized “output” in meeting the clients’ needs, involve a lesser degree of innovation and creativity in the actual performance of the work than would a Brains project. The general nature of the problem to be addressed is not unfamiliar, and the activities necessary to complete the project may be similar to those performed on other projects. Clients with Grey Hair problems seek out firms with experience in their particular type of problem. In turn, the firm sells its knowledge, its experience, and its judgment. In effect, they are saying, “Hire us because we have been through this before; we have practice at solving this type of problem.”

- Procedure projects. “The third type of project, the Procedure project, usually involves a well-recognized and familiar type of problem. While there is still a need to customize to some degree, the steps necessary to accomplish this are somewhat programmatic. The client may have the ability and resources to perform the work itself, but turns to the professional firm because the firm can perform the service more efficiently, because the firm is an outsider, or because the client’s own staff capabilities to perform the activity are somewhat constrained and are better used elsewhere. In essence, the professional firm is selling its procedures, its efficiency, its availability: “Hire us because we know how to do this and can deliver it effectively.”

The labour demands for each project are ordered in descending fashion: ‘Brain’ projects require experienced, senior staff, as nearly everything is custom-made for the client. ‘Grey Hair’ projects address problems that are more familiar, and thus provide some opportunity for delegation. ‘Procedure’ projects involve the highest proportion of junior time relative to senior time, and thus demand a completely different shape for firms that specialise in such projects.

The mix of projects that the firm undertakes is hugely influential on many aspects of the firm’s operations. Maister writes:

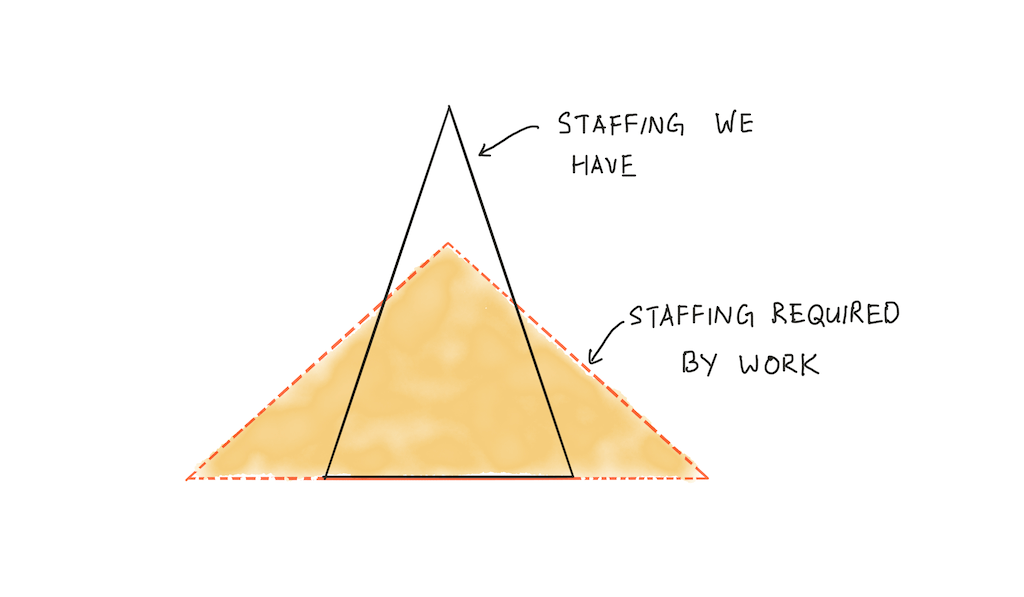

Consider what will happen if a firm brings in a mix of client work such that its “proper” staffing requirements would be for a slightly higher mix of juniors, and a lesser mix of seniors than it has (i.e., the work is slightly more procedural than the firm would normally expect). What will happen?

As Figure 1–2 suggests, the short-run consequence will be that higher priced people will end up performing lower-value tasks (probably at lower fees), and there will be an underutilization of senior personnel. The firm will make less money than it should be making.

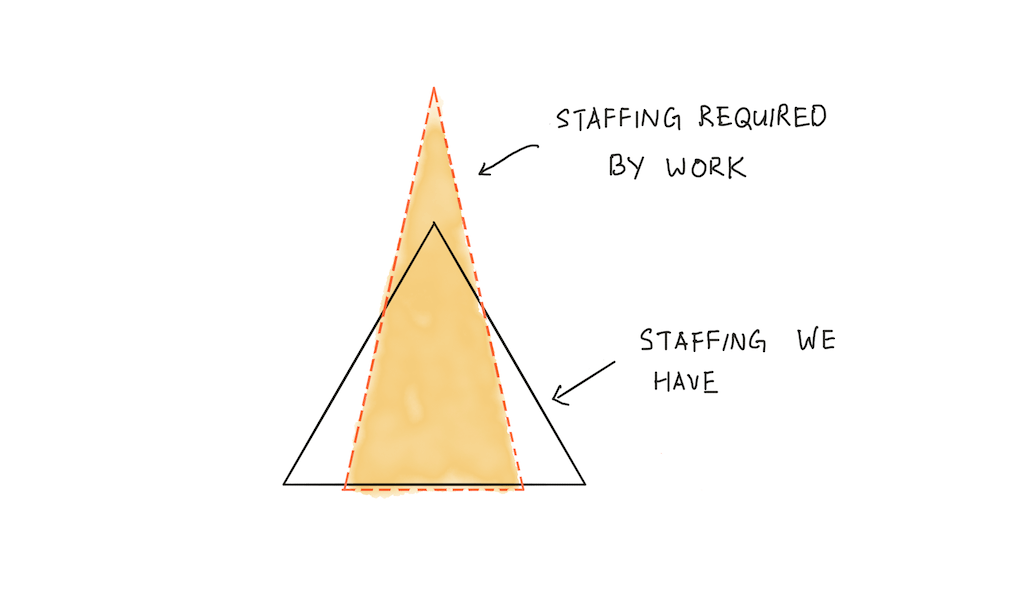

The opposite problem is no less real. If a firm brings in work that has skill requirements of a higher percentage of seniors and a lesser percentage of juniors (Figure 1–3), the consequences will be at least equally adverse: a shortfall of qualified staff to perform the tasks, and a consequent quality risk.

How Leverage Affects Hiring

A professional service firm is constrained by the market it operates in. The firm’s market is defined by its competitors, and by the types of projects that are on offer. This implies that the firm’s people strategy must stem from its project mix.

Maister captures this challenge succinctly:

People do not join professional firms for jobs, but for careers. They have strong expectations of progressing through the organization at some pace agreed to (explicitly or implicitly) in advance.

The professional service firm may be viewed as the modern embodiment of the medieval craftsman’s shop, with its apprentices, journeymen, and master craftsmen. The early years of an individual’s association with a professional service firm are, indeed, usually viewed as an apprenticeship, and the relation between juniors and seniors the same: The senior craftsmen repay the hard work and assistance of the juniors by teaching them their craft.

(…) The promotion incentive is directly influenced by two key dimensions: the normal amount of time spent at each level before being considered for promotion, and the “odds of making it” (the proportion promoted). These factors are clearly linked to a firm’s leverage structure (and its growth). For any given rate of growth, a highly leveraged firm (one with a high ratio of juniors to seniors) will offer a lower probability of “making it” to the top, since there are many juniors seeking to rise and relatively few senior slots opening up. A less leveraged firm, at the same rate of growth, will need to “bring along” a higher percentage of its juniors, thus providing a greater promotion incentive. (emphasis added)

In other words: if a firm doesn’t change its project mix, then to remain successful it must get rid of staff over time. There are limited slots the higher you go in the firm’s hierarchy. Since the firm cannot support a large number of middle-managers, and less still senior partners, most professional service firms use an ‘up-or-out policy’. Maister observes that even firms that do not use an explicit ‘up-or-out’ policy do, in fact, practice it: if you pass people over for a promotion long enough, they’ll eventually grow dissatisfied and leave.

This mandatory outflow of staff can sometimes be turned into an advantage. For instance, McKinsey’s famous alumni network has become a source of strength for the firm, as former consultants spread out through the business world and climb to positions of power … in order to sign on with the firm as clients later. Maister also observes that many of the effective firms he’s worked with have put some thought into their exit policy. After all, if you’re going to do it regularly, you might as well do it well.

(Historical side note: in the late 80s and 90s, McKinsey grew so enamoured with its ‘up-or-out’ policy that it began advising clients to do the same. In his history of the firm, author Duff McDonald writes: ‘Up-or-out might work for McKinsey, but the implicit social Darwinism sowed chaos both at Enron and elsewhere.’ We have McKinsey and its ilk to thank for the spread of ‘stack ranking’ in broader corporate America.)

The takeaway here is that the firm’s fundamental business demands that it adopt an ‘up-or-out’ policy. You should enter a professional service firm fully cognisant of the opportunities and tradeoffs it’s made in its client positioning, and therefore in its staff ratio.

If you’re entering an ‘expertise’-oriented firm as a senior partner, you might not need to be worried. But if you’re entering an ‘experience’-oriented firm as a junior, you should take a good look at the firm’s org chart to see the odds of your progressing upwards. And then — as Maister notes — you might want to look at their staff exit policy to see if the firm’s people will help you as you transition out of the firm.

At this point, you might also be able to see some of the second-order implications of firm leverage. For instance: in technology outsourcing — the prototypical example of a ‘Procedure’ oriented firm — juniors are paid relatively low wages and given little-to-no opportunity for advancement. This isn’t because of some evil corporate policy — instead, it’s because the business model forces this structure onto them. There’s no reason to do profit-sharing when margins are low for ‘Process’ work; plus the firm cannot support a large mid-level management class. And so the firm churns through juniors in the labour market, and makes no attempt to improve their lot.

This does not mean that ‘Procedure’-oriented firms aren’t profitable, as we’ll see in the next section.

How Leverage Affects Growth

The final point in Maister’s thesis is that of firm growth.

In the previous section, we talked about how firm leverage is determined by its mix of project types. But this is a static snapshot: we are assuming that the firm doesn’t grow.

Must the firm grow? Yes, it must. Recall that people join professional service firms for a career, not for a job. There is a built-in expectation that juniors should become mid-level staff members, and mid-level staff members should eventually become senior partners.

In practice, what this means is that the proportion at each level of the firm’s hierarchy must be preserved. Because promotions are expected to occur in a certain time range (e.g. junior to mid-tier in four years; mid-tier to partner in eight), you can use the ratio of staff levels and the length of promotion to calculate the firm’s ideal growth rate. This growth rate then becomes the minimum rate required to function effectively!

Maister writes:

What must be stressed at this point is that we have arrived at these staffing levels solely by considering the interaction of the firm’s leverage structure with the promotion incentives (career opportunities) that the firm promises. What we have discovered by performing these calculations is that the interaction of these two forces determines a target (or required) growth rate for the firm. As Table 1–3 shows, Guru Associates must double in size every four years solely to preserve its promotion incentives. If it grows at a lower rate than this, then either it will remove much of the incentive in the firm, or it will end up with an “unbalanced factory” (too many seniors and not enough juniors) with a consequent deleterious effect upon the firm’s economics.

If the firm attempts to grow faster than target rate, it will be placed in the position of either having to promote a higher proportion of juniors, or to promote them in a shorter period of time. Without corresponding adjustments, this could have a significant impact on the quality of services that the firm provides.”

This was totally not obvious to me as an outsider.

“Aha!” but you might think. “What about ‘Brain’-type firms? Or ‘Procedure’-oriented firms? Can’t they choose not to grow?”

You’re right — that’s totally doable. But consider the forces acting on them:

- ‘Brain’-type projects eventually turn into ‘Grey Hair’ projects. What is once cutting-edge becomes cookie-cutter — Maister calls this the ‘life-cycle’ of the client market. Therefore, ‘Brain’-oriented firms must either evolve their firm structure to attack ‘Grey Hair’ projects, or they must continually seek new frontiers to apply their expertise in order to maintain their current firm shape.

- ‘Procedure’-oriented firms suffer from continual churn, as there are extremely limited opportunities for staff growth. In software, the principals may choose to continually recruit engineers to replace the juniors churning out of the treadmill … but this means low margins, continuous price competition, and steady (but flat) profits. From experience, the principals I know who run such firms either burn out, implode from rapidly growing headcount (but not growing margins) … or they shift the firm to take on more ‘Grey Hair’ work. This is the path that’s commonly espoused in the tech industry; see here and here.

Putting it Together

In a previous post, I wrote about how business models affect careers in all sorts of important ways. Maister's book gives us perhaps the clearest example of this principle in action. You can, simply by looking at the shape of a professional service firm, predict what your career there is going to look like.

I think what’s so interesting about Maisters’s book is that it reveals several ground truths about the business of consulting. These truths are slightly counter-intuitive ... and surprisingly universal. They exist because certain economic forces shape consulting firms to function in very particular ways, with very particular outcomes. Once you understand these forces, you can recognise when firms bend the rules, and you may better predict a typical career arc in one of those firms.

Maister’s work is pretty cool. I can’t remember the last time I read a single book that answered so many of my questions about an entire industry. If you’re thinking of working for a consulting company, or if you’re planning to start one, give Managing the Professional Service Firm a read; it’s available on Kindle here. I think it’s worth your time.

Originally published , last updated .

This article is part of the Operations topic cluster, which belongs to the Business Expertise Triad. Read more from this topic here→